Getting More From Less: Will Spin-Offs Rise Post-Shire/AbbVie?

Executive Summary

Will there be a bump in the number of biopharma spin-offs in the coming months, similar to what we’re seeing in the tech industry?

It would appear that biopharma’s stint of domicile shifting, tax inversion merger plans – over $175 billion worth this year (see “2014-The Year of M&A That Wasn't![]() ,” Scrip, October 21, 2014] – has come to a screeching halt with AbbVie Inc./Shire PLC’s $1.64 billion break-up. [See Deal] New Treasury Department rules are changing that game now. In the absence of a quick tax win strategy (and turning a blind eye to the irony of the break-up fee’s tax deductible qualification), this forced shift in exit planning should inspire future biopharma mergers or divestitures based on truly meaningful company synergies, acute management focus, and stronger branding. History suggests these tactics are well accomplished and rewarded via the strategy that bred AbbVie in the first place: the spin-off.

,” Scrip, October 21, 2014] – has come to a screeching halt with AbbVie Inc./Shire PLC’s $1.64 billion break-up. [See Deal] New Treasury Department rules are changing that game now. In the absence of a quick tax win strategy (and turning a blind eye to the irony of the break-up fee’s tax deductible qualification), this forced shift in exit planning should inspire future biopharma mergers or divestitures based on truly meaningful company synergies, acute management focus, and stronger branding. History suggests these tactics are well accomplished and rewarded via the strategy that bred AbbVie in the first place: the spin-off.

Though more time-consuming (taking up to two years to complete), there are many recently and clearly demonstrated benefits of spin-offs, among them greater sales and profits for both buyer and seller, and increased shareholder value. Many companies have recognized that when they’ve divested assets seen as “non-core” or as degenerative to profits, the value of both spinner and spinnee increases, often dramatically.

Boston Consulting Group’s recent report, “Maximizing Value: Choose the Right Exit Route![]() ,” asserts that of the three types of divestitures – trade sale (straight M&A), spin-off (transfer of ownership of part of a company to shareholders), and carve-out (offering of parts of a company subsidiary to the public [IPO]) – spin-offs have been the most highly rewarded across industries. The report points to the highly successful 2012 spin-off of animal health company Zoetis by Pfizer Inc. Zoetis, now the world’s largest animal medicine company, had $4.6 billion in annual sales in 2013. Its 2013 IPO was worth over $2.2 billion, and right out of the gates the company’s market cap soared to $13 billion.

,” asserts that of the three types of divestitures – trade sale (straight M&A), spin-off (transfer of ownership of part of a company to shareholders), and carve-out (offering of parts of a company subsidiary to the public [IPO]) – spin-offs have been the most highly rewarded across industries. The report points to the highly successful 2012 spin-off of animal health company Zoetis by Pfizer Inc. Zoetis, now the world’s largest animal medicine company, had $4.6 billion in annual sales in 2013. Its 2013 IPO was worth over $2.2 billion, and right out of the gates the company’s market cap soared to $13 billion.

In the biopharma space, a prime example can be seen in the Abbott/AbbVie story itself.

In late 2011 Abbott Laboratories Inc. announced it would split the company into two parts. Late the next year it finally spun out its US drug portfolio and pipeline into AbbVie, and retained its diversified medical products, generic pharmaceuticals, diagnostics, and nutritional businesses [See Deal]. When AbbVie had its debut on the public markets in January 2013, investor approval was evident. AbbVie’s shares rose 2.8% to $35.12, giving it a valuation of around $55.5 billion. Abbott’s share price grew that day by 2.3% (to $32.05) for a valuation of $50.7 billion. Today, even in the midst of the ShAbbVie break-up, AbbVie’s market cap lingers around $97 billion and its shares trade at $59.98; Abbott’s cap is now about $65 billion ($42.74/share).

Another notable biopharma spin-off success story is Elan/Prothena Corp. PLC. In December 2012, Elan (acquired by Perrigo Co. in July 2013) [See Deal] spun out its drug discovery business into newly formed company Prothena. Elan then declared that the businesses would be worth more apart than they are together, leaving Elan free to focus on increasing sales of the flagship MS therapy Tysabri (natalizumab; Elan has since sold its share of the drug to Biogen Inc. [See Deal]), and enabling Prothena to establish its own shareholder value, based solely on its own pipeline. Elan was right. Its opening share price the day Prothena debuted on the public market was $7.88. Just before it was acquired by Perrigo in July 2013 those shares were trading at $11.58, up 47%. Prothena shares opened at $8.10; they now trade at $20.95 apiece, an impressive 158% growth.

But perhaps the timeliest spin-off advantages of all are that they are most often not subject to tax, and the shareholder value they create through greater corporate focus is palpable, even during times of market volatility.

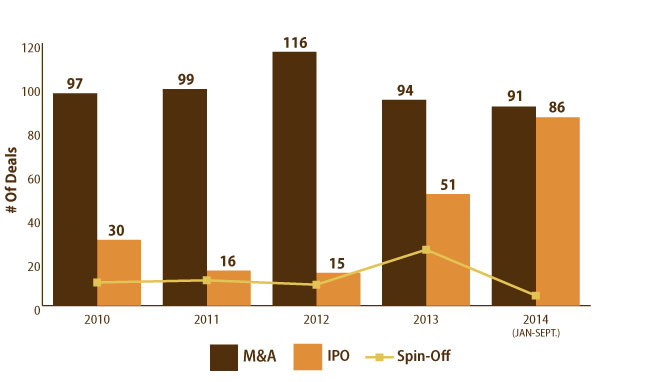

IN VIVO surveyed Informa’s Strategic Transactions for insight about exits of choice for biopharma companies over the past few years. (See Exhibit 1.) We found that the number of straight M&A deals peaked in 2012, but fell by 19% in 2013, a year known as the biggest for stocks since 1997. That decrease in M&As could be attributed to the flood of biopharmas going public in 2013 – over three times the number that IPOed the year before. And perhaps also attributable to the rise in spin-off deals that year: nearly triple the number done in 2012.

In the first three quarters of 2014, by contrast, we see very few spin-offs; a very respectable volume of M&A deals (many of which are valued over $1 billion); and a continued upswing in IPOs, 69% more in the first three quarters of this year than were done in all of 2013. (See (Also see "A Banner Year For Pharma: M&A Tops 2009 Merger Mania" - In Vivo, 18 Sep, 2014.).) But in the face of increasing market volatility and the changing regulatory backdrop, we wonder if the next several months will bring a bump in the number of pharma spin-offs, similar to what we’re seeing in the tech industry? We look forward to finding out.

Exhibit 1

Biopharma Exits, 2010-2014

M&A, IPOs, and Spin-Off Deals

Strategic Transactions