Should We Be Alarmed By Prescription Drug Cost Growth?

Executive Summary

Singling out prescription drugs as the most egregious of the health care cost sinners in spite of their relatively small role raises the question of why the media and peer-reviewed journals pay so much attention to their cost. Analysts and policymakers should avoid a myopic silo mentality and instead adopt a holistic approach that measures the value and budgetary impact of health care services across all sectors.

Policy analysts and media pundits alike assign much of the blame regarding recent increases in health care costs to prescription drugs. On one hand, they are correct to point to prescription drugs as an important driver of health care cost growth in recent years.

Although the percentage of spending on outpatient drugs has remained steady at around 10% for the last decade, specialty drugs used in hospitals and physician’s offices have accounted for significant growth in drug expenditures, bringing the total share up to about 17%. In 2014, for the first time in well over a decade we saw double-digit growth in drug expenditures.

On the other hand, drug spending overall is still a relatively small portion of the health care pie. As such, concerns stemming from increasing prescription drug cost growth may be somewhat misplaced. Even at the height of its spike in 2014 the increase in per capita drug spending constituted only around 2% of total health care spending per enrollee in public and private insurance plans.

Broadly, growth in health care spending is driven by:

- An aging population exercising greater demand for health care (hospital, physician, outpatient, nursing home) services

- Higher prices for health care services demanded

- New diagnostic and therapeutic technologies, including newly approved drugs

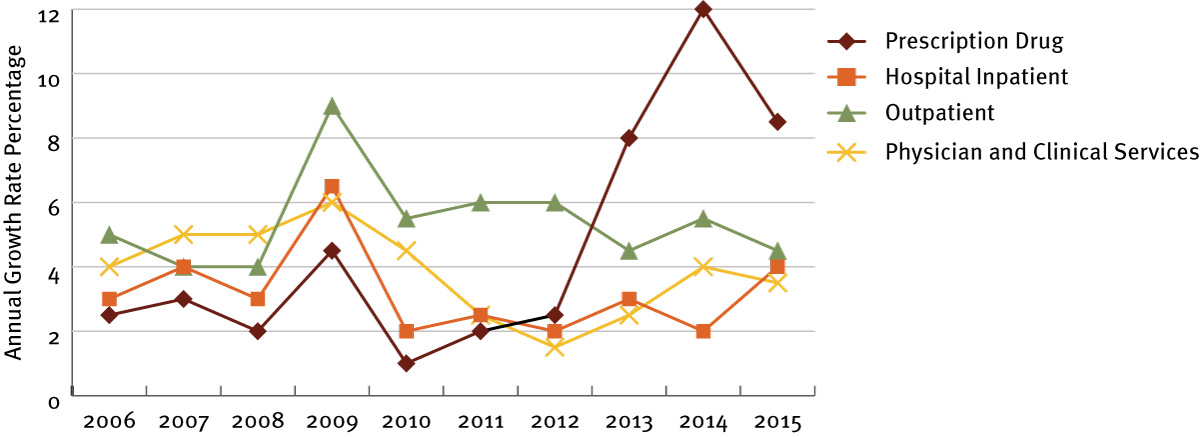

Together, hospital and physician expenditures account for three times the spending on drugs. And, despite the recent uptick in the rate of drug cost growth, over the past 10 years the pace of hospital and physician expenditures has generally exceeded prescription drugs. (See Exhibit 1.)

Apparently, these facts do not make for eye-catching headlines. By contrast, the recent surge in the price of newly approved drugs targeting hepatitis C, HIV and various cancer and orphan diseases is salient and the focus of media attention. A case in point is the recently reported 50-fold price increase of Turing Pharmaceuticals AG's Daraprim (pyrimethamine), which drew the ire of politicians, policymakers and patient advocates. Several other drugs have gained notoriety, including recent revelations regarding steep price hikes of Mylan NV's EpiPen (epinephrine).

Analysts often point to international comparisons of health care spending with the US ranked first, attributing differences to the relatively high costs of prescription drugs in the US. Indeed, per capita spending on health care in the US was $9,086 in 2013, two-and-a-half times the Organization for Economic Cooperation and Development median for 13 high-income countries.

The relatively high price of branded drugs is one of several contributing factors. Other factors include physician salaries, which are two to four times the OECD average, the costs of surgical procedures and diagnostics that are up to four times the average, and the price per day for hospital stays that is five times the average.

Exhibit 1 Health Care Sector Annual Growth Rates (2006–2015)

Source: Adapted from Chappel A, Sheingold S, Nguyen N, ASPE Issue Brief, "Health care spending growth and federal policy," March 22, 2016; Catlin A, Cowan C, Centers for Medicare and Medicaid Services, November 19, 2005, "History of health spending in the United States, 1960–2013"

In the next decade health care spending is projected to grow at an average rate of 5.8% per year, according to the Centers for Medicare and Medicaid Services. In addition, the health care share of the gross domestic product is expected to rise from its current 17.5% to 20.1% by 2025. This increase will be driven by hospital inpatient and outpatient services, physician and clinical services and prescription drugs (average annual growth of 4.9%, 5.4% and 6.2%, respectively, for the 2016–2025 period).

Because hospital and physician services constitute greater shares of total health care spending, 32% and 22%, respectively, and in the next 10 years are expected to grow at an annual pace comparable to prescription drugs, they will continue to be more impactful drivers of US health care cost growth. In fact, PwC estimates that over this period hospital and physician service expenditures are predicted to increase by more than four times the cumulative projected rise in prescription drug spending.

Singling out prescription drugs as the most egregious of the cost sinners in spite of their relatively small role raises the question of why so much attention is paid in the media and peer-reviewed journals to the cost of prescription drugs. Perhaps this is because prescription drugs are salient in ways that physician and hospital services are not. Nevertheless, analysts and policymakers should avoid adopting a myopic silo mentality. They should evaluate the value and budgetary impact of health care services across all sectors (e.g., use of expensive equipment such as robotic surgery systems and positron emission tomography scans, expensive procedures such as cesarean sections, routine annual health care exams and new specialty drugs for cancer or infectious diseases.)

It is important, therefore, to examine the bigger picture, and not limit the focus of cost containment to prescription drugs. A better way moving forward is for policymakers to adopt a holistic approach aimed at measuring value of each health service, diagnostic or therapeutic. Clinical- and cost-effectiveness is a useful proxy for value in that it informs decision makers how much health benefit is likely to be produced by different uses of resources. But other factors should be considered, too, including severity of illness targeted by a drug or health service. Policymakers should also resist the temptation to view the various sectors as silos that do not interact with one another. In some instances, pharmaceuticals may result in a shifting of costs – more in pharmaceuticals, less in other sectors (e.g., cardiovascular, peptic ulcer, HIV/AIDS, hepatitis C and certain diabetes and cancer medications). In other therapeutic categories drugs will add to cost growth without displacing costs in other sectors. In conclusion, policymakers need to examine the value of all health services, including prescription drugs, through comprehensive clinical- and cost-effectiveness analyses, as well as budget impact studies.

Joshua Cohen, PhD ([email protected]) is Research Associate Professor at Tufts Center for the Study of Drug Development. His areas of expertise include prescription drug pricing and reimbursement policy, patient access to biopharmaceuticals, comparative effectiveness research and prescription-to-OTC switching.