The Bigger Picture And Global Innovation Hotspots

Executive Summary

Focusing too much on the US provides a blinkered view of the industry and prevents access to the myriad opportunities on offer globally.

More than ever, the biopharmaceutical industry is a global affair. The lure of the US is undoubtedly huge, accounting for approximately 40% of total prescription revenues, thanks in part to an incredible 18% of its gross domestic product (GDP) spent on health care. As such, dynamics within the largest market can often have far-reaching consequences, such as directing portfolio strategy for multinational companies and influencing the timing and size of financing and acquisition decisions. However, focusing too much on the US provides a blinkered view of the industry and prevents access to the myriad opportunities on offer globally. In Vivo explores some of the innovation hotspots in the rest of the world and how these are poised to shape the global picture in the years to come.

Gene Therapy Development In China

After three decades of fine-tuning, gene therapies are now finally emerging as potential curative treatment options across a range of therapeutic areas and high unmet need diseases. Expanding the definition to include cellular or viral therapies that have been genetically modified ex vivo, there are currently 12 gene therapies approved anywhere in the world, while a further three have been withdrawn from the market. The first classic therapy delivering a healthy copy of a gene directly into a patient, Novartis AG’s Luxturna (voretigene neparvovec), was approved in 2017 and a whole host of therapies are set to follow.

There are large number of obstacles facing this novel treatment modality as it matures, not least the scientific validation across different diseases, but also regulatory, commercial, manufacturing and logistical hurdles to overcome. As expected, the US biotech sector is a leading contributor to the early development work of gene therapies, rising to meet these challenges, but entrepreneurial Chinese biotechs are increasingly taking on the mantle. Two companies in particular, Hrain Biotechnology and Hebei Senlang Biotechnology, have the largest pipeline of internally discovered gene therapies of any company globally, according to data from Pharmaprojects (see Exhibit 1), which tracks drug development all the way from preclinical assets to widely launched brands.

|

Company |

Originator drugs |

Licensed drugs |

|

Hrain Biotechnology |

20 |

n/a |

|

Hebei Senlang Biotechnology |

19 |

n/a |

|

Editas |

16 |

n/a |

|

Sangamo Therapeutics |

16 |

2 |

|

Regenxbio |

15 |

7 |

|

Precigen |

13 |

1 |

|

Shanghai Unicar-Therapy Bio-medicine Technology |

13 |

n/a |

|

Amicus Therapeutics |

12 |

n/a |

|

Autolus |

12 |

n/a |

|

Genethon |

12 |

3 |

China is also a leading location of clinical trials for gene therapies, demonstrating that it is equipped to manufacture these products on scale, while demand for supply of viral vectors among Western CDMOs can act as a bottleneck, with various reports suggesting a waitlist of up to two years. Part of the success story is the intense involvement of academic centres in China, providing much-needed investment into the gene therapy space, compensating for the weaker early-stage fundraising environment.

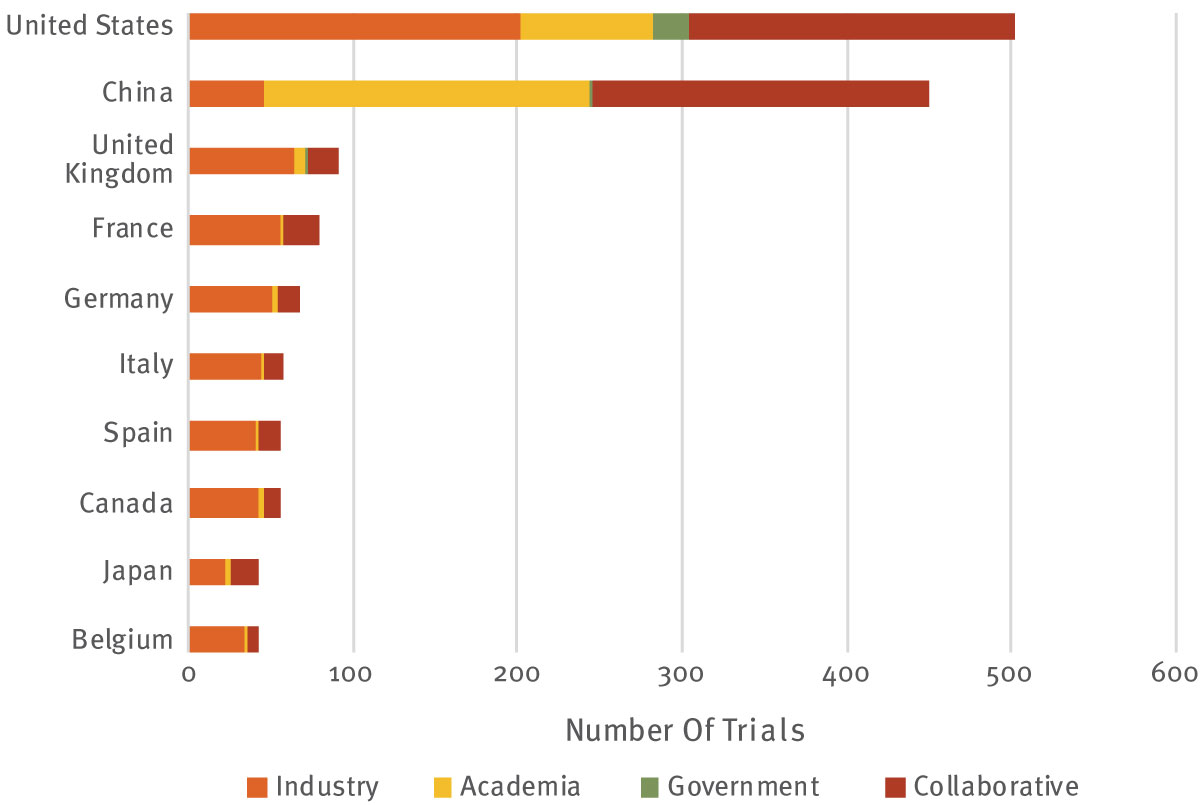

As shown in Exhibit 2 , China is the global leader in ongoing academic gene therapy clinical trials, and is a close second to the US for all sponsor types. As of spring 2020, there were 503 ongoing gene therapy trials in the US, compared to 451 in China, although an impressive 90% of these Chinese trials are sponsored either by academia alone or in collaboration with another organization. The corresponding proportion in the US is 60%, while academic involvement in trials operating in European countries falls to a lowly 20-30%.

Gene therapy has undoubted clinical potential, and with an abundance of research coming out of Chinese laboratories, the next question is whether domestic biotech companies will be equipped to lead on commercialization. Thus far, few Chinese-originated drugs are available in US and European markets, and the early model for advanced therapies is one of partnership. One recent example is the licensing agreement between Legend Biotech and Johnson & Johnson for the CAR-T drug LCAR-B38M, commanding a healthy $350m upfront payment. While BeiGene Ltd., a flag bearer for Chinese R&D innovation, succumbed to the lure of an established commercial entity, selling a 20.5% equity stake to Amgen Inc. for $2.7bn in October 2019. Based on the current dynamic, Chinese biotech is certainly well positioned in the engine room for gene therapy discovery but is unlikely to break through as global commercial enterprises, providing big pharma multinationals with ample business development opportunities.

Early Clinical Trials In Australia

On the global scale, Australia sits in a relatively modest position on a variety of metrics considering its population of approximately 25 million people and excellent health care coverage, provided by the Pharmaceutical Benefits Scheme (PBS). The industry body AusBiotech proudly touts Australia as among the top five countries globally for biotech, with its lofty position in the Scientific American Worldview scoring driven by its productivity, quality of workforce and government policy. Nevertheless, Australia lags somewhat behind its peers on financial measures such as prescription drug expenditure (14th largest market globally), while recent fundraising activity across financing and partnership deals is dwarfed by the totals achieved by companies in South Korea, Canada, and smaller European countries such as the Netherlands and Belgium.

However, one area in which Australia punches above its weight and can rightly claim to be globally competitive is in clinical trials, and especially with early-stage development.

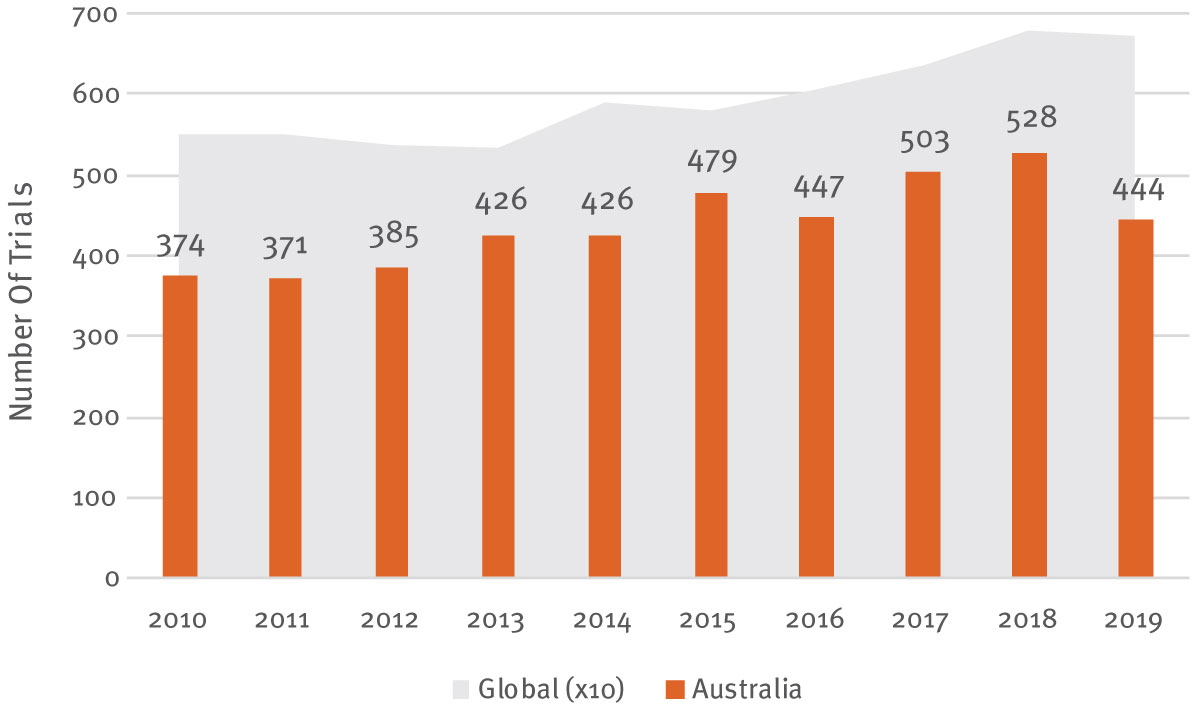

Multinationals are increasingly attracted to Australia to perform clinical research not only as part of global registration programs, but also to conduct single location Phase I studies. As shown in Exhibit 3 , clinical trial growth in Australia over the last decade has outpaced that of the wider industry. Collectively, the biopharma industry initiated just shy of 60,000 trials over 2010-2019, 7% of which (4,383 trials) included at least one study location in Australia. Excluding the slight blip in 2019 – there is commonly a lag in reporting full study locations for new clinical trials – the number of trials in Australia grew at a compound annual growth rate of 4.4%, exceeding the 2.7% global figure in the period to 2018. Overall, this is enough to place Australia in 12th position globally for the number of industry-sponsored trials over the whole decade, rising to 10th when looking at new starts in 2019 alone.

The statistics are even more favorable for early-stage research: Australia ranks as the fourth most common country globally for Phase I and I/II studies initiated in the last year, behind only China, the US and the UK. It is certainly a powerhouse for pharmacokinetic and safety studies, where the Clinical Trial Notification (CTN) scheme enables a company to get approval for a trial in as little as six weeks, contrasting INDs in the US taking, potentially, up to a year.

Finances also play a hugely important role for the attractiveness of performing clinical research in Australia. The government is notoriously supportive of business. It invests heavily to support the biopharma industry both directly via research funding and indirectly via tax rebates. Australia’s competitive R&D tax incentive scheme provides companies with a refundable tax credit in the region of 38.5-43.5% for research conducted in Australia, with eligibility recently raised up to an expenditure cap of AUD$150m ($105m). This is one of the factors why like-for-like clinical research can be notably cheaper in Australia than many other developed countries.

The federal government also invests around AUD$850m annually in health research via the National Health and Medical Research Council (NHMRC), and separately established the AUD$20bn Medical Research Future Fund (MRFF) in 2015. This fund has already enabled the creation of eight large scale public health missions since 2017, spanning a wide range of health care challenges. Once fully operational, the fund will support an additional AUD$650m annual investment. Although smaller, the government has also set up the AUD$500m biomedical translation fund, which provides companies with venture capital to develop and commercialize biomedical discoveries in Australia, boosting the domestic industry with the stipulation that the investment stays within Australia.

AI-Enabled Drug Discovery In The UK

The past year has been notable in the number of alliances signed between large biopharma companies and specialists operating in the artificial intelligence (AI)-enabled drug discovery niche. Furthermore, in May 2019 the influential Tufts Center for the Study of Drug Development reported results from its own industry survey, with 59% of respondents planning to expand AI staff through 2020, suggesting its widespread and growing uptake across drug development. (Also see "PharmAI – Industry Is Smartening Up To Potential Of Artificial Intelligence" - In Vivo, 3 Jun, 2019.)

The fundamental driver behind this is to improve R&D productivity, bringing rationally designed medicines with scientifically validated mechanisms into the most appropriate patients, all in a shorter space of time and with a greater probability of technical success. Pure computational power and iterative machine learning (ML) processes enables these algorithms to process an incomparably greater amount of data to the human brain, which when allied to our current understanding of disease and scientific intuition, produces highly optimized drug discovery programs. The field is certainly nascent, but is taking off rapidly with investor support and numerous lucrative partnership arrangements between pharma and AI pioneers, several of which are based in the ‘Golden Triangle’ of the UK; Cambridge, Oxford and London. Two companies in particular, Exscientia and BenevolentAI, are among the frontrunners in terms of clinical milestones and high-profile alliances.

Exscientia Ltd., headquartered in Oxford and with offices in Dundee and Osaka, claimed in January 2020 to have become the first AI company to discover a drug that has progressed into human clinical trials. Its collaboration with Sumitomo Dainippon Pharma Co. Ltd. yielded a drug candidate for obsessive-compulsive disorder, reaching the point of entering clinical trials within 12 months of program inception, in contrast to several years of preclinical work based on standard timelines. Previously, Exscientia delivered its first lead molecule to GlaxoSmithKline plc in a COPD-focused research program, reaching this milestone after testing just 85 compounds across five development cycles, prompting chief research officer Andy Bell to effuse about his company’s industry-leading AI discovery platform. (Also see "The Drug Hunter’s Assistant: Accelerating Drug Discovery With AI" - In Vivo, 25 Nov, 2019.) The company also has ongoing collaborations with five other large pharmaceutical companies, while progressing various co-development and internal programs centred on oncology, immunology and fibrosis.

BenevolentAI may have been beaten to these key milestones by its near neighbour, but it is also working to advance the use of AI across the whole drug development progress. The company holds a London headquarters and maintains proximity to Cambridge via a research facility. Last year, BenevolentAI announced collaborations with both Novartis and AstraZeneca PLC, separately raising $269m across three funding rounds since 2014. As the company progresses, it continues to evolve its knowledge graph, a vast network of distinct data sources aiming to yield a better understanding of biological complexity. This can then be used to implicate known targets in potentially new indications, optimizing drug design against these and eventually enrolling the most likely patients to respond into clinical trials. Its internal amyotrophic lateral sclerosis (ALS) drug discovery program is borne out of a target previously studied in breast cancer, while its platform has even been used to propose the repurposing of JAK inhibitor baricitinib as an adjunct to antivirals in the treatment of COVID-19. Demonstrating the breadth of its capabilities, BenevolentAI’s commercial relationships are targeted against oncology, chronic kidney disease, and idiopathic pulmonary fibrosis.

AI-ML certainly has its limitations and, like many new technologies, falls victim to being over-hyped. Organic chemist and renowned industry blogger Derek Lowe is rather scathing in his assessment of the novelty that the Sumitomo Dainippon/Exscientia drug offers. “This project, at best, seems to me to have shaved a few months off the process of sending their compound into the same black-box shredder as every such drug project goes into when it hits human trials.” The key limitation of AI-ML algorithms is that they do not advance our collective scientific understanding by themselves, and do not circumvent the key destruction of value in R&D – failure of proof-of-concept efficacy trials. As a 5-HT1a agonist, the Sumitomo Dainippon/Exscientia drug DSP-1181 is not at all unique pharmacologically and binds a target that is not definitively linked with the disease state. Nevertheless, this is a single example and over the coming years, multiple case studies will help to reconcile its technological promise with clinical reality. Eventually, many processes within AI-enabled drug discovery will become embedded in biopharma best practices, with data science expertise becoming a core capability rather than a buzzword. It would not be a surprise should a big pharma company move in this direction via an acquisition, especially if the AI specialist itself generates an attractive internal pipeline.

Until this point, it will be the role of specialist companies such as Exscientia and BenevolentAI to continue to validate the technology and achieve the next key milestone of producing the first AI-designed drug to gain regulatory approval.