Academia Meets The Market – Part One

The What, Why And How Behind UCLA’s Billion Dollar Stake In Life Sciences Research

Executive Summary

New drug development is an increasingly communal enterprise. In Vivo examines how one major US academic institution – the University of California at Los Angeles (UCLA) – is expanding its range of research contacts to open new areas of therapy and shorten the transition from bench to the bedside. Its commercial impact is considerable: over the past two decades, private-sector VC’s have invested more than $2bn in UCLA-backed innovations, with 26 start-ups launched through the university in 2019 alone. Amir Naiberg, UCLA’s point man on technology transfer, explains the factors that have made the university a successful advocate for partnerships that produce results for patients.

Collaborations between industry and academia are a common feature of today’s biopharma R&D landscape. Well over half of FDA-approved new chemical entities rely on externally generated research at some point in the journey from discovery to development. Factors driving this trend include academic scientists’ focus on the complex biology that underpins pathogenic expression of disease; high costs of in-house industry R&D coupled with financial pressures on universities due to declining public funding support; more transparency on intellectual property standards for tech transfers involving industry and academia; and a relaxation of industry concerns about “open innovation,” resulting in a greater tolerance for risk, on both sides. More important, new studies published in the past year on drug industry trends in R&D productivity cite growth in external partnering as one explanation for an uptick in the rate of return on capitalized R&D investment, after decades of decline.

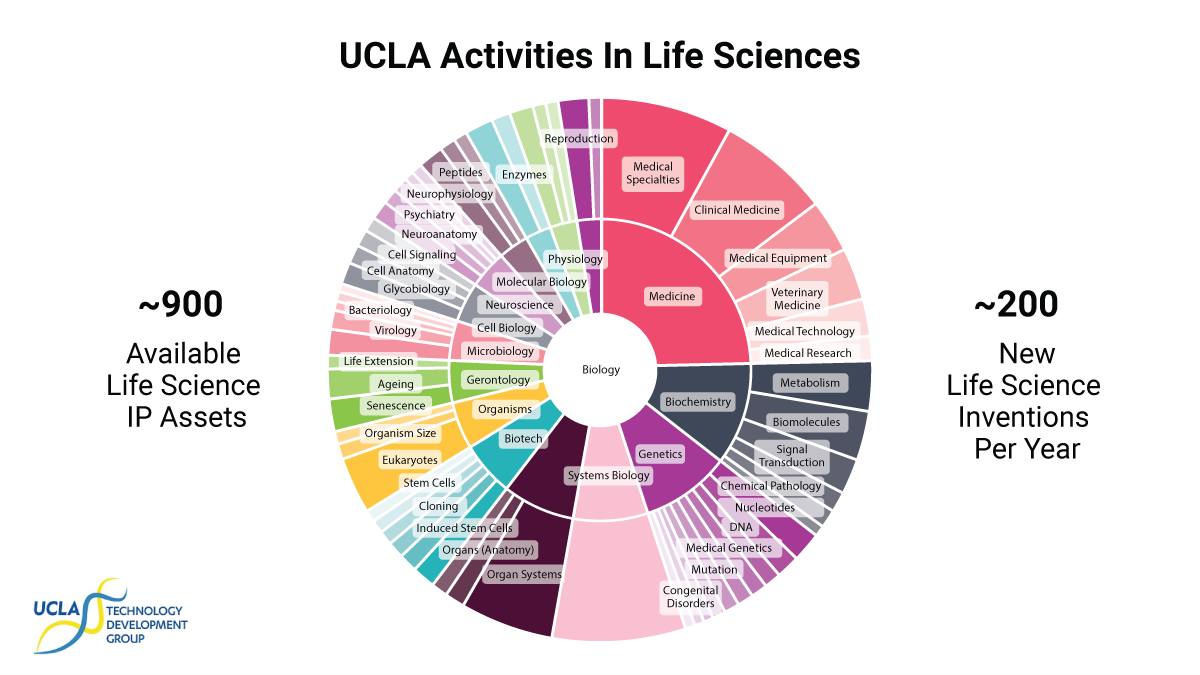

To cast some fresh light on how academia and biopharma are working together to speed the translation of research from bench to bedside, In Vivo has profiled one of the academic community’s leading sources of technology transfer with industry, the University of California at Los Angeles (UCLA) Technology Development Group (TDG). Now five years old, TDG has unique legal status within the university as an external 501(c)(3) corporation with dedicated responsibility for managing UCLA’s IP and licensing portfolio consisting of more than 1,000 active patents, a trove that generated a record $183m in income for UCLA in 2019. In the first three quarters of 2020, UCLA had secured $1.4bn in new research funding, a 20% increase over 2019. More than half – $754m – will be spent on bioscience and other health-related projects at UCLA’s Geffen School of Medicine. The federal National Institutes of Health (NIH) is the largest single funding contributor, awarding grants worth $565m to projects in AIDS, cancer, neurosciences, cardiovascular disease, COVID-19 and mental health. Industry sponsored research adds another $53m. Overall, UCLA ranks in the top five US academic institutions in research funding, and is first among public universities.

UCLA has a proven record as an innovator in drug discovery. Its research faculty played key roles in the development of three blockbuster cancer drugs: Herceptin (trastuzumab), the first targeted therapy for breast cancer; Gleevec (imatinib), another targeted therapy for leukemia, which evolved from UCLA researchers’ discovery that genetic alterations could cause cancer; and, most recently, Xtandi (enzalutamide), approved by the FDA in 2012 and again in 2019, and now the global market leader in new hormonal therapies for advanced metastatic prostate cancer. Erleada (apalutamide), a drug from Janssen (a division of Johnson & Johnson) approved for the same indication in 2018, also originated in UCLA Professor Michael Jung’s biochemistry lab.

On the entrepreneurial side, UCLA has a flourishing start-up culture, with 26 start-ups launched by faculty and associates in 2019 alone. Its commercial relevance is demonstrated by the fact that the private-sector VC community has invested $2bn in UCLA companies during the past two decades. The business focus is reinforced by TDG’s board of directors, whose 21 members include seven executives from big pharma and biotech.

To get a closer look at the priorities of this mainstay of tech transfer in the US top-ranked public university, In Vivo spoke with TDG’s CEO and associate vice chancellor, Amir Naiberg. Having joined TDG in 2016, Naiberg is a veteran of Israel’s start-up culture, serving as CEO of Yeda Research & Development Co., the commercial arm of the Weizmann Institute of Science and as co-chair of the Israel Technology Transfer Organization, which helped solidify the country’s reputation as the “Start-Up Nation.” He remains a strong advocate of moving research more quickly from the lab to the marketplace, and is particularly focused on helping positioning the Los Angeles region as a leader in global life sciences innovation. Naiberg is joined by In Vivo Editorial Advisory Board member, Dr. Ken Schultz, CEO and Chair of Trethera Corp., an early-stage biotech based in Los Angeles whose pipeline has also benefited from some of the science conducted in UCLA labs.

The Technology Development Corp., the 501( c )(3) established six years ago to oversee TDG’s mission, helps UCLA’s research faculty bring its life-changing discoveries to the market faster, creating economic value and advancing the standard of care for patients. Of course, making this happen in real-time required some creativity. It was necessary to tie what was a disaggregated flow of research expertise into a coherent framework that would allow us to match this expertise to the best external opportunities. It required a cultural change in that our most productive faculty had a history of pursuing start-up ventures on their own, without leveraging the partnering capabilities embedded within the vast UCLA ecosystem. This year alone, UCLA scientists have received a record $1.4bn in research grants, nearly half of which is earmarked for medicine and the life sciences. Making the world outside our labs aware of that is the essence of what we do.

TDG consists of three functional pillars. The first is business development, where our people work with faculty to identify innovations and develop external applications for their research, arrange contacts with interested parties and facilitate deals. The second is industry-sponsored research, where we support everything from material transfer agreements to long-term collaborative research activities. We also have a central function role, such as managing business and tech transfer operations, such as marketing and licensing inventions; prosecuting patents; distributing royalties and other income to inventors and various UCLA departments and labs; educating the UCLA student body and community about tech transfer issues; and evaluating the commercial value of new technologies. Third is New Ventures, which involves managing the UCLA Innovation Fund, which seeks to fill the funding gap between basic research at UCLA and commercial development through modest grants that cover those interim steps like proof-of-concept and clinical validation studies.

UCLA is highly diversified in the life sciences so our work ranges from physical sciences and engineering to medical devices and diagnostics, drug therapeutics, and advanced software like artificial intelligence. We spend much of our time bringing to the table external partners with background to secure, value and monetize inventions developed across the UCLA campus. One of our more exciting recent examples of the Innovation Fund is the licensing of an AI algorithm for spine MRI evaluations to a local, faculty founded start-up, Theseus AI Inc.

We like it because it brings a structured, “baked-in” process to academic-industry collaborations, minimizing a lot of the transactional friction that can occur when business partners try to negotiate financing, licensing/IP rights and due diligence on their own. Despite the COVID-19 distractions, Autobahn has already had discussions with 80 UCLA faculty members to share project ideas and I expect this to result in several brokered agreements on new start-ups by the beginning of 2021. I think the relationship with Autobahn is an important precedent that puts UCLA in the lead in bridging the translational science gap you just mentioned.

Another example where we innovate is our growing focus on the convergence between the tech sector and the life sciences. In June, UCLA signed a three-year research partnership with Apple Inc. as part of the university’s inter-disciplinary Depression Grand Challenge project geared to finding objective, evidence-driven metrics for diagnosis and treatment of this disease. It is notable that major depression, which afflicts an estimated 300 million people worldwide, still relies on the old tool of personal observation to track symptoms. Under the agreement with Apple, which TDG helped execute, the company will supply more than 3,000 study participants with smart watches and the Beddit sleep monitor to record individual behaviors in real time. With Apple’s help, we are able to do all this research remotely, which represents a practice model that has resonance during a pandemic. I see the Apple agreement as a milestone for TDG as it enables us to diversify around key industries of the future outside of medicine.

That’s why right now we are putting the emphasis on partnering. I can point to a recent precedent where UCLA professor of medicine Dennis Slamon initiated the clinical trials that led to approval of Genentech’s Herceptin (trastuzumab), one of the first targeted monoclonal drugs for cancer. He also collaborates with Brian Stoltz’s chemistry lab at the California Institute Technology (Caltech) on a novel molecular construction for the treatment of cancer. Together with Caltech and some local investors, we spun a company from their joint work that continues to generate new compounds which can be evaluated quickly and efficiently for therapeutic potential and then moved to a clinical trial network affiliated with UCLA. I believe that to this day it is one the best models of how translational research delivers clinical results to many thousands of cancer patients. Although the present crisis around COVID-19 is certainly a setback, the example of this long-standing collaboration gives us a useful set of tools that we can replicate once campus life resumes.

Finally, TDG relies on UCLA’s large alumni network as a rich source for new business development opportunities. Here in Los Angeles, there is a large group of affluent alumni outside biotech in areas like finance and entertainment who are personally familiar with UCLA’s world-class medical institutions and may have benefited from that care. These business “angels” are proving useful in filling some of the gaps in start-up financing, especially for that initial seed round.