How Pharma Can Navigate Ups And Downs Of Vertical Integration In US

New Survey Of Leading US Experts Illuminates Potential Entry Point For Pharma With Integrated Entities Across The Value Chain

Executive Summary

Together, we will improve patient health and experiences while lowering costs across the continuum of care.” This quote, from Andrew Witty, CEO of US health services management company Optum, after the company sealed its acquisition of DaVita Medical Group in 2019, encapsulates the oft-declared goals of vertical integration: efficiencies, improved quality of care, reduced costs. But is this the reality?

Vertical integration – broadly defined as the combination of entities at different levels of the health care supply chain, such as when hospitals acquire physician practices or health plans acquire pharmacy benefit managers – is certainly on the rise.

Around half of all primary care physicians in the US are now affiliated with vertically integrated health systems, up from 38% in 2016. And that number is likely to keep rising. The focus of US policymakers is on improving health outcomes and championing patient-centeredness as a core element of health care value and on the surface of it, vertical integration supports this drive. The COVID-19 crisis only increases the rationale for a better organized health care system achieving higher value care.

With much of the supply chain already integrated and more mergers on the horizon, are we starting to see some of the stated benefits of vertical integration? And what do these expanding entities mean to the pharmaceutical companies trying to engage with them?

Patient View: Theoretical Benefits Not Being Realized

Is vertical integration having an impact on patient outcomes?

An Executive Insight survey of leading US health care experts, including health insurers, PBMs and providers, found that only half (49%) of respondents felt that US patients are benefitting from better health care as a result of such mergers.

In the recent literature, a systematic review by Machta et al in 2018 found that vertical integration in the US was associated with improvements only in a few measures of quality around specific conditions. While a 2019 study from Rice University’s Baker Institute for Public Policy revealed that vertical integration in health care has little to no impact on care quality across a range of performance measures, including hospital readmission rates, length of stay and patient satisfaction. There were exceptions, but these were a limited set of processes such as continuation of beta blockers for surgical patients.

Horizontal integration – where the same types of entity merge, whether hospitals or physician practices – has been proven to reduce costs, due to factors such as central purchasing and investments, and better negotiation position with suppliers. But with vertical integration it is less clear; efficiencies are more difficult to disentangle across the value chain. There are certainly cost efficiencies to be gained – health insurer Cigna claimed its purchase of PBM Express Scripts will generate $625 million in administrative cost savings alone over the next three years. But who is benefitting from these efficiencies beyond shareholders?

Reports on vertical integration in the US have found that the mergers have not yet introduced significant reductions in cost. While Goldsmith et al in 2015 found little evidence that hospital-physician structural integration was able to yield improved cost outcomes.

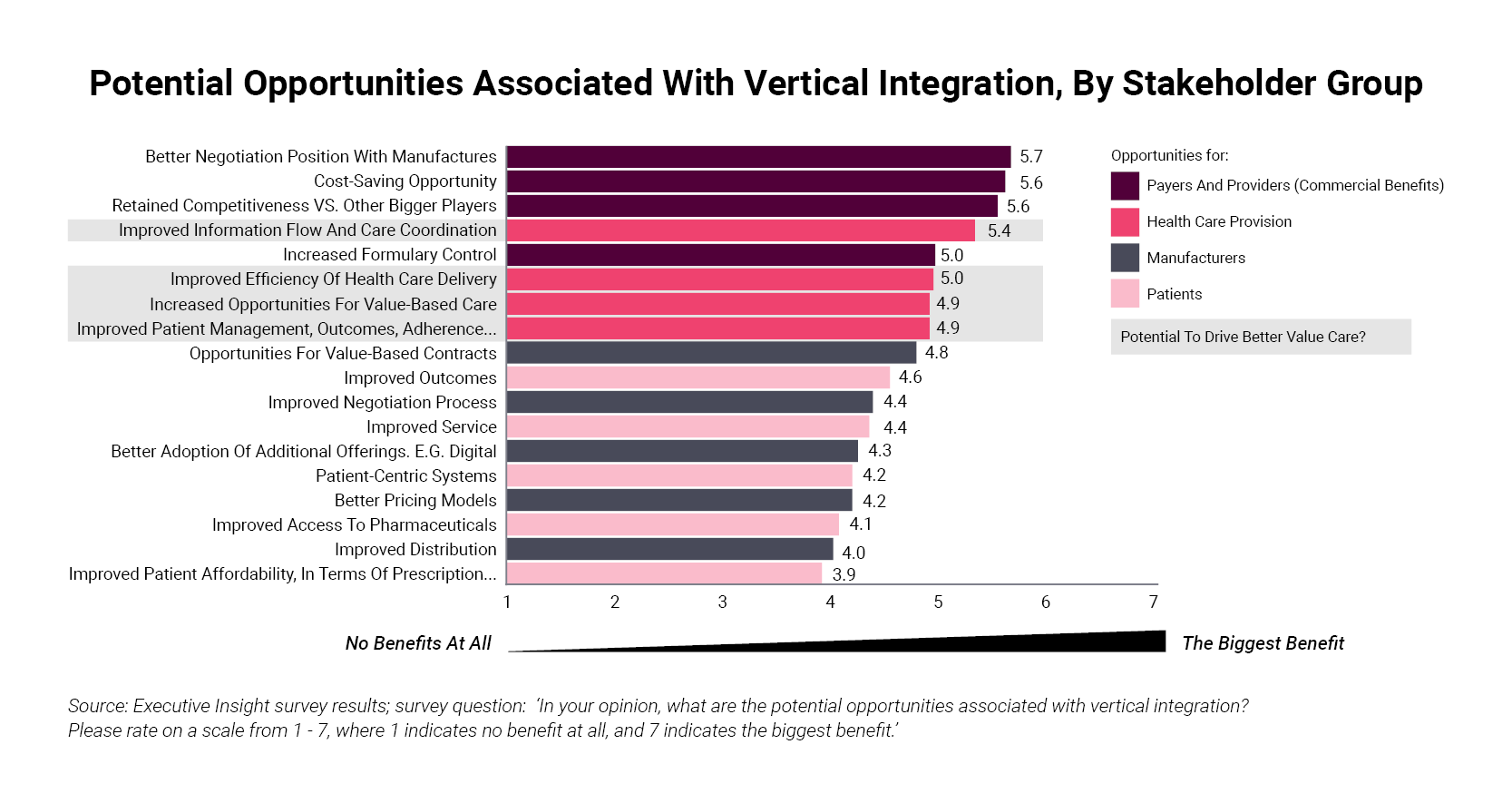

What about impact on the cost of pharmaceuticals? In the Executive Insight survey, payers and providers ranked “better negotiating position with manufacturers” as the biggest benefit of vertical integration (see Exhibit 1).

Certainly, reducing drug costs has been front and center of the publicity surrounding many of these mergers. Health insurer Anthem announced that it expects to save $4bn on drug costs a year by switching to an internal PBM with its acquisition of IngenioRx.

Who stands to benefit from such savings? Not the patient, according to 68% of respondents in the Executive Insight survey, who believe that patients will not benefit from any net price decrease in medications. Anthem claimed that about 80% of those $4bn annual savings should return to consumers in the form of lower costs, while 20% will be returned to shareholders.

“I question how much of these types of savings are going back into the patients’ pockets,” said Dan Ollendorf, director, value measurement and global health initiatives at the Tufts Center for the Evaluation of Value and Risk in Health. “Patients are still paying an enormous amount of money out of their own pockets and this has been exacerbated by the previous PBM model. It’s still too soon to know if some of these larger mergers are going to modify that in a significant way.”

Pharma View: A Changing Dynamic

On first glance, vertically integrated entities leave pharmaceutical companies in a weaker negotiating position – with increased pressure to justify drug prices, while ceding control over drug exclusion lists and utilization.

But there are positives to be taken. The potential for more value-based contracting and better pricing models as a result of negotiating for provision of medicines across the whole value chain is clear. Vertically integrated entities inherently have a greater focus on total cost of care. With the pharmacy and medical benefits housed together under one roof, integrated entities should be more receptive to engaging in value-based contracts.

“It does depend somewhat on what type of integration we are talking about, but if it’s a large insurer with large provider group for example, then the appetite for a value-based payment approach would be greater if the incentives were aligned with the payer,” said Ollendorf. “It’s important to stress that this is different than an outcome-based pricing agreement – this is more about having value-based approaches that focus on quality and outcomes of care.”

More than two-thirds (68%) of US experts in the Executive Insight survey agreed that the number of value or outcomes-based agreements will increase due to vertical integration. For pharmaceutical companies, this new dynamic provides opportunities that were not necessarily there before. PBMs historically have not been receptive to value-based contracting because they mostly rely on traditional rebates to maintain their profitability. But as a part of vertically integrated entities, with a greater focus on total cost of care, they should be much more receptive to these types of arrangements.

Connected Systems

There are still some practical challenges to outcomes-based agreements, such as outcomes data-gathering and analysis, but these may also improve in vertically integrated settings. In the Executive Insight survey, infrastructure barriers, including IT, were identified as the greatest hurdle to outcomes-based agreements. But in theory, if several entities combine at various stages of the supply chain, it creates the potential for simpler and more effective information sharing across integrated systems, thus overcoming this barrier.

“Getting the IT systems to work together is always one of the biggest challenges in a merger and it can be quite burdensome,” said Ollendorf. “But in an ideal world, a merger should provide the opportunity to upgrade IT systems and make them more interoperable with each other.”

Improved IT infrastructure is contingent on necessary investments at merger commencement, but the gains – including easier data collection, improved analytics, potential for monitoring outcomes at the population level and opportunities for digital health offerings – can all contribute to better value care.

Tailored Value-Based Pricing Solutions

For pharmaceutical companies, tailored value-based pricing solutions should be proposed from the start of negotiations with vertically integrated entities. The opportunity to sell the holistic benefits of a product – for example if it results in significant reductions in hospitalizations or physician visits – will be better received from the start.

More nuanced outcomes and endpoints may be better received by entities responsible for the whole value chain of care. There is an opportunity for pharmaceutical companies to move beyond traditional prescription-centric outcomes.

Optimized information flow and IT infrastructure on the customer side also makes tracking and monitoring outcomes of value-based pricing agreements more straightforward and accurate, and provides opportunities for companies to align their own digital solutions.

What is the downside of this approach? “A key challenge for manufacturers is shareholder expectation,” said Ollendorf. “This is a big issue. Value to shareholders supersedes value to the customer. Now, some companies are publicly stating that they are shifting the value perspective to focus more on the customer, but we’ll have to see.”

It also means more work and coordination at an earlier stage in the product’s lifecycle to build a compelling rationale around the value of the product and ensure the means to optimize and measure this value are in place. From this foundation, outcomes-based agreements are easier to build. But these are factors companies increasingly need to consider at an early stage of development.

And early negotiations with vertically integrated entities may also open doors to different solutions. Manufacturers could add value to integrated entities beyond the provision of therapeutics. “Manufacturers could also convene groups of experts, especially in rare diseases, to track how outcomes are evolving,” said Ollendorf. “It is these sorts of areas where standard practice is rapidly evolving, and it could be the manufacturer that helps the payer to keep track of the situation and stay on top of it.”

Recognizing The Benefits

Stakeholders across the value chain have seen the opportunity for improved efficiencies and synergies with vertical integration and the potential for cost savings. Whether those savings will benefit patients, either in terms of improved outcomes or finances, is debatable, and it is important that these mergers are scrutinized to ensure the patient is not squeezed out of any potential value they may bring.

For pharmaceutical companies, it is important to recognize and act on the benefits of these new entities. There is a significant opportunity to enter negotiations with tailored value-based pricing solutions, and vertically integrated entities may offer additional levers to help demonstrate the value. In particular, integrated entities should help to overcome infrastructure barriers, including IT, which previously would have been one of the greatest hurdles to outcomes-based agreements.

Vertical integration may present new opportunities for pharmaceutical companies to propose tailored value-based pricing solutions from the start of negotiations.

About The Authors

Michalina Jenkins, PhD, is a senior consultant, and Dr. Caroline C. Conti is a principal at Executive Insight, a boutique consultancy focusing on life sciences. Ross D. Williams is a freelance writer.