European Healthtech Grabs The Investor Headlines In H1 2022

Cautious Optimism For Sector And M&A Set To Stay Strong In 2022

Executive Summary

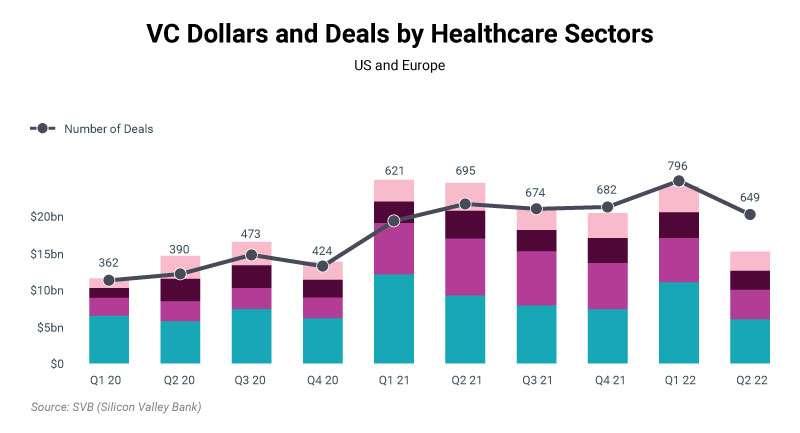

After a runaway 2021 and a strong if bumpy Q1 2022, all health care product sectors underwent an investment dip in Q2, says Silicon Valley Bank. Healthtech in Europe remained a stand-out performer.

Investment activity in biopharma, healthtech, diagnostics and tools and medtech in the first half of 2022 had to be assessed against the backdrop of a volatile macro and economic environment. While Q1 remained very strong in an uncertain market, in Q2, on the public market side, the ride got more bumpy. This led to a dip in investment in all four subsectors, compared with Q1.

That was the overall assessment of the market from Silicon Valley Bank’s Sophie Ehrlich, a London-based healthtech banker heading up SVB’s healthtech and medtech units for the EMEA region. But SVB is cautiously optimistic about the period ahead, she said, as the bank unveiled its mid-year 2022 health care investments and exits reports.

In comments to the press at the bank’s EMEA headquarters in London, Ehrlich said that healthtech in Europe had a very good first half of 2022, totaling $2.2bn of investment made – 91% of the full-year 2021 investment total. In 2022, Europe could see more investment than in 2021, which is both surprising and very optimistic, she added. Meanwhile, US healthtech saw a dip in the first half of 2022, to $8bn.

Seen another way, European healthtech investment accounted for 22% of the healthtech total in H1 2022, compared with just 9% for the whole of 2021. Seed and series A investment of $2.4bn (in 274 deals) in the first half of 2022 alone was the same as for the whole of 2020. Against 2021, it was 62% of that year’s total of $3.9bn (in 506 deals).

Q1 of 2022 was the biggest quarter on record for healthtech seed/series A investments, but in Q2, investment dropped by 40%, as investors slowed their pace due to the public market correction.

Later-stage healthtech financings fell short of the blockbuster performance of H1 2021, said SVB’s H1 2022 report. And while there were three mega-rounds of over $100m in Q1, that activity also declined significantly in Q2.

The largest single subsector of healthtech currently is clinical trials enablement i.e., digitizing the drug discovery and drug development process. “Digitizing clinical trials is in the spotlight in the first half of 2022,” said Ehrlich, and not only for the $834m (in the US and Europe) in seed and series A; in fact, it was the subsector that took most of the funding in the US and EMEA.

Investment in provider operations, and in alternative care (while declining), remained strong. Provider operations had $661m invested in the first half and alternative care, $610m. They were the two largest healthtech subsectors in terms of deal numbers, at 108 and 69, respectively, in the first half of 2022.

Alternative Care Is Here To Stay

Venture investors have recognized that alternative care is “here to stay,” and in H1 2022 they were focused more on early-stage investments at lower valuations than later-stage, more expensive companies. Three major alternative care deals during the period focused on senior care: EmpowerMeWellness ($100m), Pine Park Health ($44m) and Amada Senior Care ($22m).

While $10.2bn is the value of pure healthtech investment, with overlap (given that some companies straddle more than one stool as far as sector definitions are concerned), healthtech investments for the first half of 2022 totaled $17.7bn (in 723 deals), including private financings by venture-backed companies in the US and Europe.

The eye-catching investment of €500m ($550m) in French health care consultation app Doctolib skewed the European healthtech figures somewhat. But Ehrlich said the H1 totals remained impressive both with and without this one investment transaction.

According to Doctolib’s March 2022 figures, its technology is claimed to have won 70 million patients and has 300,000 health care professionals signed up to it in France and Germany (March 2022 figures; source Doctolib).

Doctolib was one of three alternative care companies, along with Somatus (kidney disease integrated care) and Biofourmis (AI-backed personalized and predictive care), to have secured a financing of over $300m in H1 2022. In full-year 2021, there had been 13.

SVB noted a strong increase in the number of alternative care women’s health deals, with 14 seed/series A investments in H1 2022, just two fewer than in the full-year 2021. This is indicative of personalized and specialty care being extended to broader patient populations.

Fertility and pregnancy have been good opportunities for financings. Examples are Kindbody ($30m in H1 2022); and, for all stages of life, such as Evernow ($29m), a menopause-focused company. In 2021, the holistic medical clinic for women Tia secured $100m in 2021.

SVB also expects increased investment in other women’s health subsectors, and for established women’s health companies to expand beyond fertility. Early-stage investment into hybrid and virtual care will continue throughout 2022, the bank predicted.

Healthtech Stocks’ Performance Dissuades IPO Activity

There were no healthtech IPOs in H1 2022 – for the first time in five years ̶ against the record 16 notched up in full-year 2021, as public healthtech stocks’ performance fell in the public markets.

Two of the three largest healthtech IPOs of 2021, Oscar Health and Bright Health, as of July 2022 remained significantly down from their IPO price. Doximity was up 34%, at the time of release of the SVB report. Uncertainty persists in the public market. The bank expects IPO activity to remain muted. It says the public markets will reward sustainable metrics and profitability more than a “growth-at-all-costs” approach.

Healthtech M&A during H2 2022 was at 56% of the full-2021 level, and is “still going strong,” said Ehrlich, despite what SVB called “choppy markets.” However, M&A activity declined in Q2, and overall deal values were down in the first half.

In H1 2022, there were just five publicly disclosed healthtech M&A deals of over $50m, led by two provider operations with M&A valued at over $300m. In full-year 2021, there had been 33 deals of over $50m. Ehrlich added: “The number of deals is less but the size is greater. We do believe that M&A will continue to stay strong in healthtech.”

A driver in this will be acquirers seeking to leverage younger companies’ technology as a means of building stronger relationships with providers and delivering better navigation around the health care system for patients.

SVB expects well-positioned venture-backed healthtech companies to continue to be acquisitive in the space, but also that the pace of healthtech investment will continue to slow into H2 2022.

Devices

Later-stage venture capital investment continued to drive robust device investment activity in H1 2022, despite the public market headwinds referred to earlier. In H1 2022, $4.6bn of capital was deployed across 266 device deals.

Broadly-focused life sciences investors have shown an appetite for adding new device start-ups to their portfolios, preferring them to biopharma, which has undergone poor post-IPO performance in recent quarters.

Non-invasive monitoring companies continued to dominate later-stage device deal flow. Private unicorns flourished in H1 2022, notably, the Sequoia-backed Athelas, which is developing a device for at-home immune system monitoring. It raised $59m (at a $1.5bn pre-money valuation).

Among early-stage deals, Casana, whose smart toilet seat passively captures cardiac health parameters, was an eye-catcher, as were Gala Therapeutics (devices for pulmonary disease), Crossliner (a guide to aid cardiac catheterization procedures) and KoyaMedical (wearable compression system for lymphedema and venous diseases).

Notable later-stage deal successes, besides Athelas, were Podimetrics (prevention of diabetic foot complications), Diabeloop SAS (AI paired with a glucose monitor to automate diabetes treatment) and CardioFocus (a device to advance cardiac ablation treatment). SVB also noted seven “down rounds,” more than any other sector, it pointed out.

Device IPOs was a closed public market and, as in healthtech, there were no IPOs in H1 2022. M&A also suffered, and, with many emerging acquirers appearing to stay focused internally, there were only six device deals in H1 2022.

Commenting on current health care investment trends, Mike Anstey, a partner at Cambridge Innovation Capital Fund (UK), observed that it takes five to seven or even 10 years to grow a big life sciences business company. That requires focus and understanding, both of the end goal and the value inflection points. Companies must ensure they are well financed on that path.

In the somewhat muted environment described by SVB, Anstey, whose practice provides growth capital to IP-rich companies, stressed that people are still open for business. The difference was that that “now we just have more time to do the diligence work and relations-build with founders,” he said. Investors will ensure they maintain discipline – there is no fundamental change there.

Outlook For H2

As to the rest of 2022, SVB predicts Q3 2022 investment into healthtech will drop to 2020 levels before bouncing back in Q4. But there will be lower valuations and fewer mega-deals, as public markets continue to put pressure on private valuations.

The top healthtech companies will continue to raise capital, through more insider and bridge rounds, but SVB thinks more down rounds are likely. Acquirers will likely be more selective and look for targets that either add value to their current offerings or provide additional talent.

In diagnostics, slow private M&A is expected to continue until valuations in the public market settle, likely ending with 12-16 M&A deals for 2022. Private companies may consider pursuing IPOs, possibly leading to a single-digit IPOs tally in H2 2022.

In devices, a slowdown in early and later-stage investment is likely in H2 2022, as many later-stage companies will defer raising large outsider-led rounds. M&A activity should rebound slightly in H2, probably dominated by larger acquirers. Biopharma could see 15-20 IPOs, and a modest uptick in private M&A, SVB predicts.

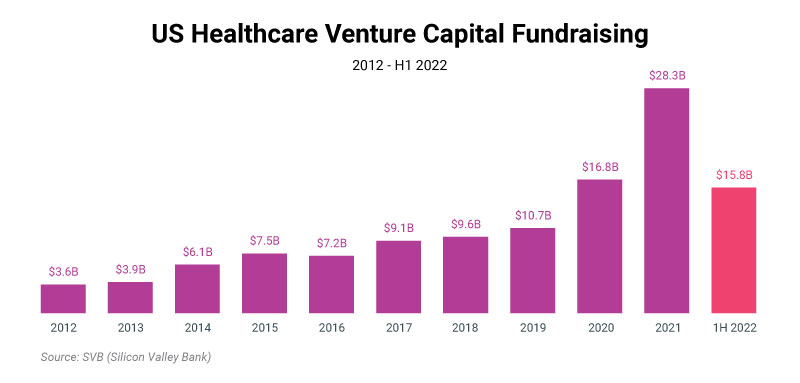

In terms of fundraising and investments across the board, VCs are expected to slow their deal pace compared with 2021, but with continued investment from recently closed funds, 2022 is still shaping up to be second biggest investment year ever, behind 2021, said SVB.