The Growth Path For Drug Discovery Partners

Pharma And PE Acquisitions Of Outsourcing Partners Set To Continue

Executive Summary

Drug discovery services is one of the fastest growing areas of outsourcing because of pharma's increasing reliance on the companies operating within the field. This trend is causing increased interest from both pharma and PE-backed companies.

Historically, drug discovery services such as chemistry and biology have been kept in-house, close to the IP heart of pharmaceuticals and biotechnology. However, in an increasingly competitive market, pharma and biotech have moved to a partnering model with contract research organizations (CROs) or drug discovery specialists to accelerate the successful number of drug candidates to progress and more effectively test across the pre-clinical phase. There is a growing trend toward outsourcing drug discovery and other pre-clinical services.

As pharma outsourcing increases, total outsourced pre-clinical development is expected to grow at a CAGR of 8% from 2021 onwards. This growth rate makes discovery services one of the fastest growing areas of outsourcing. During 2021, outsourced pre-clinical drug development spend totalled $6.1bn, according to figures from global investment bank Lincoln International.

Drug Discovery Organizations Pivot in the Face of Headwinds

While the industry has seen growing reliance on outsourced partners in recent years, CROs are facing their own challenges in today’s market.

Biotech funding was robust during the last three years, with biotech companies raising more than $34bn in 2021—double the total seen in 2020, according to figures from McKinsey. However, that funding has dried up significantly in 2022, including funding which would ultimately fuel supporting CROs and service providers. Amid these market conditions, CROs have turned to developing future-looking capabilities, including building out technology offerings to attract and retain clients less dependent on biotech funding cycles.

At the same time, staffing shortages impacting businesses across sectors have also hit this market. Competition for talent remains a top priority, especially for mid-tier scientists with many companies in the market feeling a shortage in talent. This is an increasing area of focus across mergers and acquisitions (M&A) transactions.

M&A Dynamics

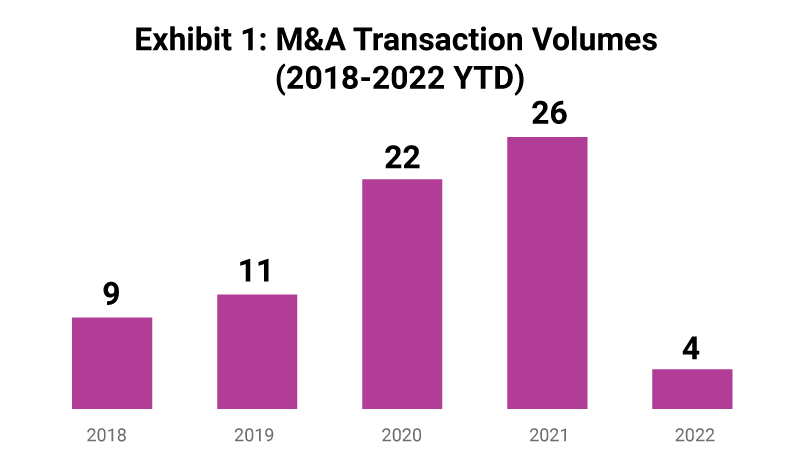

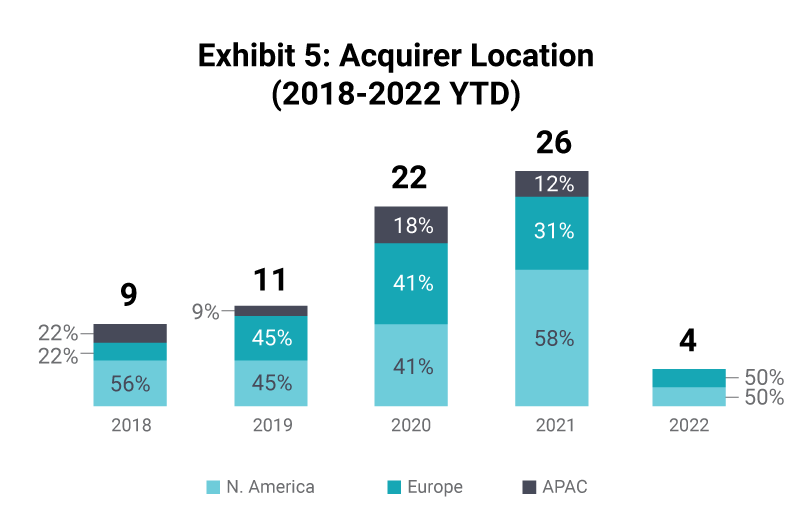

M&A across the industry has resulted in several notable trends in recent years as the volume of pre-clinical CRO transactions increased rapidly from 2018/19 to 2020/21. 2022 YTD volumes remain muted, however, considering the heightened activity in prior years this is expected to regain ground going forward.

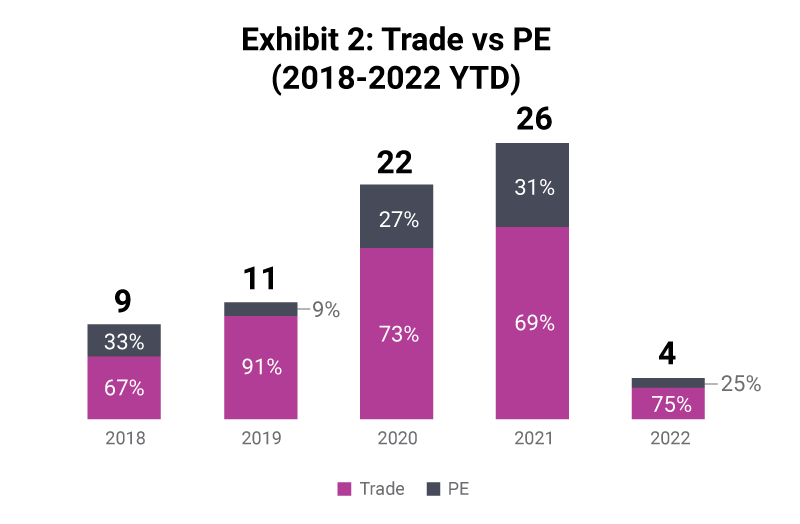

The onset of covid-19 saw an influx of private capital into the pre-clinical space, with private equity acquirers moving up to account for 31% of deals in 2021. This trend is expected to stabilise as the space remains attractive to invest in by both corporates and PE-backed companies.

Trade acquirers continue to make acquisitions to bolster capabilities or geographic reach, however these have typically been smaller value transactions. In these scenarios, acquisitions are primarily driven by seeking a niche set of capabilities or skills which are difficult to replicate elsewhere, and the target’s service offering could be closer to a product offering in nature. Having a defined and deep expertise in one area can make for an attractive target and increased valuation.

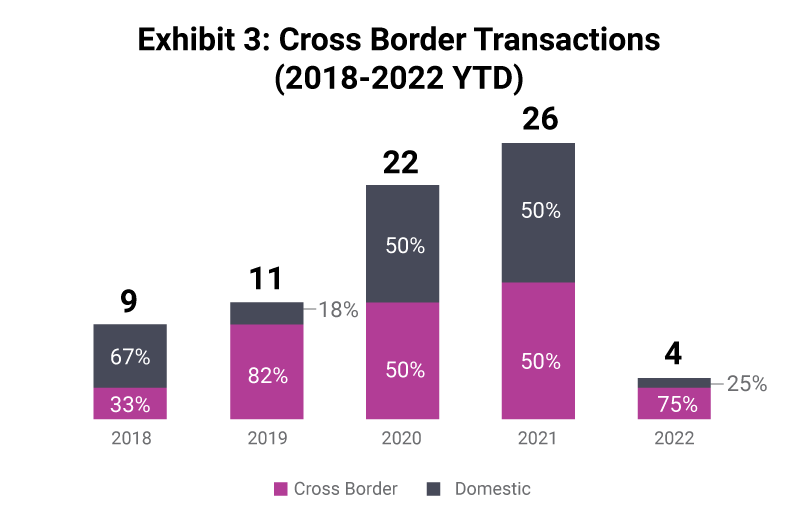

Cross-border transactions have consistently been a key part of the industry with many companies seeking to broaden reach through M&A. Typically, in any given year there will be more cross border transactions than domestic ones. This characteristic is expected to continue as the market remains global and for the larger CRO platforms, having worldwide reach and expertise is a key factor in securing and successfully executing projects for clients.

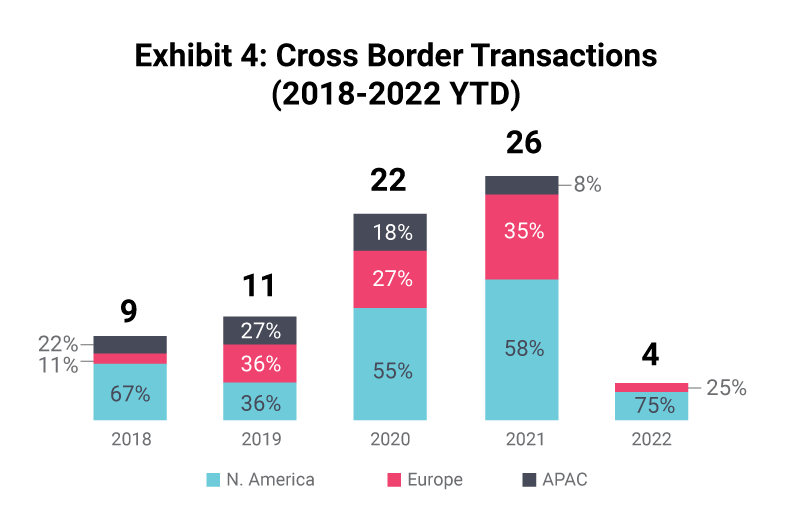

The US is set to be the biggest market for pre-clinical CROs, given the location of pharma spend and clinical trials. There have been reduced levels of transactions in the APAC region, which is dominated by Chinese headquartered CROs, representing up to 80% of transactions. Globally, US acquirers are the most dominant, accounting for just under half of total transactions between 2018-2022.

Overall, M&A remains a core part of the growth strategy for many pre-clinical CROs. Access to new technologies and specialisms across pre-clinical phases allows niche providers to emerge as full-service partners.

Several strategies can set drug discovery specialists apart, such as the use of artificial intelligence tools, specialization, and a global outlook. Technology is fast becoming a key offering among CROs, but AI capabilities are transforming the speed and productivity of the drug discovery process and are viewed as a premium offering. AI can increase the efficiency of testing alongside the ability to identify a wider range of targets.

Buyers will see value in specialization. Companies that can specialize in drug development for high growth therapy areas like rare diseases, autoimmune diseases or oncology are especially attractive. As PE players build out their platforms, they look to acquire specialty capabilities not yet captured in their portfolios. To add to their suite of capabilities, buyers will look for companies on the cutting edge of new technology and drug treatments, even for diseases that were recently unresearched.

A global offering will attract a sophisticated acquirer. Companies with a global footprint and strategy for selling across borders can unlock an additional universe of acquirers. As the pharma market becomes more and more global, there’s an indisputable benefit to selling drug discovery services across geographic markets. During the sale process, CROs can expect PE investors to inquire about plans to expand presence in new regions with lab locations and management strategy.

The Way Ahead

In spite of the highly testing and uncertain macro-economic and geopolitical environments, and the recent blip in biotech funding, the long-term demand for outsourced pre-clinical services remains strong.

Outsourcing suppliers that can demonstrate sustainable and differentiated value will become increasingly attractive acquisition targets. But creating that competitive edge is tough. Buyers will also be challenged by seeking out the right strategic assets and conducting the appropriate levels of due diligence to ensure target companies meet their requirements.

James West is director of mergers and acquisitions at Lincoln International. He advises mid-market company owners and investors on M&A. His focus spans the pharmaceutical and pharmaceutical services sectors, advising on both buy-sides and sell-sides. Specifically, he has advised on transactions covering commercial, manufacturing and research; pharmaceutical products and generics; and medical technology, devices and diagnostics sectors.