Immunotherapies Set To Spark Alzheimer's Drug Market

Executive Summary

Five late-stage Alzheimer's disease candidates, three of them monoclonal antibodies, are projected to rack up big sales when they launch, according to a new report by Datamonitor Healthcare. Like the rest of the AD drug market, growth for these products will come from treating earlier stages of the disease (article free with registration).

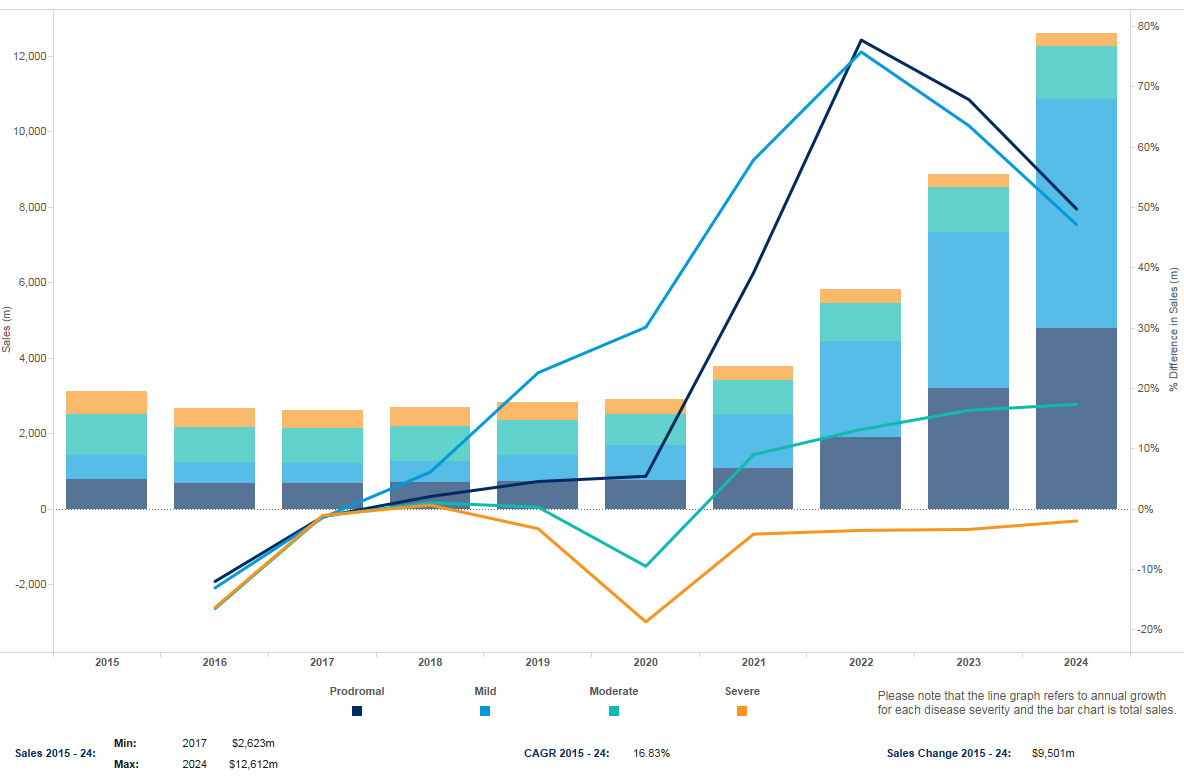

Sales of Alzheimer’s disease drugs across the US, Japan and five major EU markets (France, Germany, Italy, Spain and the UK) totaled $3.1 billion in 2015. By 2024, the AD market is forecast to reach $12.6 billion, a compound annual growth rate (CAGR) of 16.83%, according to "Alzheimer's Disease Forecast," a new report by Informa's Datamonitor Healthcare analyst Maha Elsayed, PhD.

The US is the largest major market for Alzheimer’s disease drugs, with an estimated 2015 value of $1.75 billion. The large US patient population and the high volume of annual prescriptions (2.72 million in 2015) contribute to its size, as do the premiums that companies charge for their AD drugs. For example, Eisai Co. Ltd./Pfizer Inc.'s Aricept (donepezil) carries a 2015 ex-manufacturer price of around $2,256 per year in the US compared with annual prices of $839 in Japan and $199 to $640 in the five major EU markets. US prices are expected to further increase during Datamonitor's forecast period of 2015–24, whereas prices in Europe and Japan will mostly either decline or remain stable, particularly once exclusivity has been lost.

Immunotherapies Will Drive Growth

As we noted in In Vivo a few months ago, as drug development shifts toward treating early-stage, prodromal patients, the Alzheimer's market will expand considerably and much of that growth will be driven by the anticipated availability of expensive, late-stage immunotherapy candidates. (Also see "Alzheimer's Disease: Defusing The Bomb By 2025" - In Vivo, 18 May, 2016.)

The amyloid-based immunotherapies aducanumab (Biogen Inc./Eisai), crenezumab (Roche) and solanezumab (Eli Lilly & Co.), expected to launch during 2017−21, have the potential to grow the market by $9.3 billion in annual sales by 2024. Should aducanumab demonstrate similar efficacy in its Phase III trial as in its Phase Ib PRIME study, it is expected to be the market leader ($4.08 billion), followed by solanezumab ($4.05 billion) and then crenezumab ($1.17 billion). (See Exhibit 1.) These drugs will be prescribed alongside existing therapies, although their uptake will be hindered by their high price points: amyloid-based immunotherapies are expected to be priced in line with leading biologics for inflammatory indications, equivalent to 13 times greater than Aricept in the US. As such, Datamonitor Healthcare forecasts that around 540,000 patients with prodromal or mild Alzheimer’s disease will receive immunotherapies by 2024 in the US, Japan and five major EU markets.

Exhibit 1

Late-Stage AD Candidates, Projected Sales ($m)

|

AD Candidate |

Target |

Launch Date |

Estimated Sales, 2024 |

|

Aducanumab (Biogen/Eisai) |

Amyloid |

Feb. 2021 |

4,076 |

|

Crenezumab (Roche) |

Amyoid |

Aug. 2021 |

1,170 |

|

Idalopirdine (Lundbeck/Otsuka) |

5-HT6 |

March 2018 |

648 |

|

RVT-101 (Axovant Sciences) |

5-HT6 |

Oct. 2018 |

865 |

|

Solanezumab (Eli Lilly) |

Amyloid |

Oct. 2017 |

4,051 |

Note: Launch date and estimated sales for US, Japan, France, Germany, Italy, Spain and UK. Sales projections for crenezumab, idalopirdine and RVT-101 do not include Japan. Datamonitor Healthcare | Pharma Intelligence, 2016

In a companion report, "Alzheimer's Disease Pipeline," Datamonitor handicaps five promising late-stage AD candidates: the three monoclonal antibodies and two small-molecule 5-hydroxytryptamine-6 (5-HT6) receptor antagonists.

- Aducanumab: The first amyloid-beta-targeting drug to show target engagement and improvements to both cognitive and functional endpoints in patients with early Alzheimer’s disease. The positive data from the Phase Ib PRIME study prompted the launch of a larger Phase III program, although the high incidences of amyloid-related imaging abnormalities suggestive of sulcal effusion and parenchymal edema (ARIA-E) that were dose- and apolipoprotein E4 (ApoE4)-dependent will require careful mitigation strategies. As such, the success of Biogen’s Phase III program hinges not only on demonstrating clinical efficacy on a newly adopted clinical endpoint, but also controlling adverse effects. Unmanageable ARIA-E incidences could result in drug discontinuation and patient dropouts, impacting the study outcomes.

- Crenezumab: Despite questionable signs of cognitive efficacy in the ABBY Phase II study in mild to moderate Alzheimer’s disease, Roche was encouraged to launch a Phase III study following the positive outcome of Biogen’s PRIME trial of aducanumab. While the PRIME study might have rejuvenated hope in the amyloid-beta hypothesis to treat the early stages of AD, Roche’s decision to progress crenezumab into late-stage trials is certainly speculative. Nevertheless, crenezumab has hypothetical benefits that may allow for higher doses and greater tolerability, meaning the drug has a likelihood of success comparable to aducanumab in Phase III trials for early-stage Alzheimer’s disease.

- Solanezumab: The most clinically advanced amyloid-beta monoclonal antibody in the pipeline, having already undergone two global Phase III trials. While these studies, EXPEDITION 1 and EXPEDITION 2, failed to provide sufficient evidence to support regulatory filing in mild to moderate Alzheimer’s disease, they did demonstrate a sign of efficacy in mild AD, which Eli Lilly is now investigating in a third study, EXPEDITION 3. Although this third trial could delay any potential regulatory filing by several years, it will provide more conclusive evidence for the drug’s disease-modifying properties and cognitive benefit in the more appropriate mild Alzheimer’s disease population. In addition, the company is extending solanezumab’s efficacy evaluation to the prodromal population and to patients at risk for developing Alzheimer’s disease. However, although the current data are statistically significant, there is a danger that solanezumab’s slight effect on slowing cognitive decline is not necessarily relevant for clinical practice.

Despite the Phase II failure of Pfizer's serotonin 5-HT6 antagonist PF-05212377, Datamonitor projects that two other candidates in that class (Lundbeck Inc./Otsuka Pharmaceutical Co. Ltd.'s idalopirdine and Axovant Sciences Ltd.'s RVT-101) may have an impact during the forecast period, with potential market values of $648 million and $865 million in 2024, respectively. (Also see "Full Monty On Pfizer’s Failed 5-HT6 Alzheimer’s Drug Leaves Hope For Class" - Scrip, 25 Jul, 2016.) RVT-101 is forecasted to capture a higher market value, given its improved efficacy profile. These symptomatic pipeline drugs are forecasted to generate smaller market value than immunotherapies because there is less clinical need for them, and their uptake may be hindered by the widespread availability of generic symptomatic competitors. Furthermore, unlike amyloid-based immunotherapies, they are not expected to command premium pricing.

- Idalopirdine: Following positive Phase II data in moderate Alzheimer’s disease, Lundbeck joined forces with Otsuka and quickly transitioned idalopirdine into Phase III trials. In late September, Lundbeck announced that in the first Phase III study, STARSHINE, idalopirdine showed a weak efficacy profile: neither of the two dosages used in the study met the primary endpoint of a reduction in the Alzheimer's Disease Assessment Scale-cognitive subscale total score when added to donepezil. In addition, the secondary endpoints did not show separation from placebo, although idalopirdine was safe and well tolerated. Elsayed noted to In Vivo's sister publication Scrip that “The failure of idalopirdine in demonstrating efficacy in the STARSHINE study is disappointing, but not too surprising given that doses of 30mg and 60mg per day tested in the Phase III trial were lower that the 90mg dose tested in a successful Phase II study, probably to reduce side effects, but at the expense of positive efficacy." (Also see "Lundbeck’s STARSHINE Fades As Idalopirdine Fails First Phase III Alzheimer’s Test" - Scrip, 23 Sep, 2016.) The two remaining Phase III studies, STARBEAM and STARBRIGHT will continue as planned and data are expected in the first quarter of 2017. With Lundbeck’s EU presence and Otsuka’s geographic reach, the companies are well placed to capitalize on idalopirdine’s novel mechanism should the remaining Phase III results warrant further development.

- RVT-101: Elsayed thinks that the second pipeline candidate in the 5-HT6 class has a better chance for Phase III success because Axovant Sciences is testing a higher dose than Lundbeck did with idalopirdine. RTV-101's new mode of action and Phase III clinical trial design will allow for positioning as an adjunct treatment, thereby avoiding generic competition. While its Phase II studies gave inconclusive data, prompting the drug’s discontinuation by former developer GlaxoSmithKline PLC, RVT-101 was resurrected in 2014 by Axovant Sciences in a $5 million deal. [See Deal] This developmental delay allowed competing drug idalopirdine to advance ahead of RVT-101 in Phase III trials, although RVT-101’s improved efficacy profile may give it an advantage to idalopirdine.

Early-Stage AD Treatments Will Become Extremely Lucrative

Products for treating the earlier stages of Alzheimer’s disease are expected to have the greatest growth potential from 2015–24. Datamonitor Healthcare forecasts that the market for prodromal and mild Alzheimer’s disease will grow at CAGRs of 22.21% and 28.72%, respectively. By 2024, the AD market will be changed considerably, with sales of drugs for the earliest stages of disease accounting for 86.15% of the total.

Exhibit 2 Alzheimer’s Disease Market Sales Value By Disease Severity, 2015–2024 ($m) Note: Projected sales for US, Japan, France, Germany, Italy, Spain and UK. Datamonitor Healthcare | Pharma Intelligence, 2016

Unlike aducanumab and crenezumab, solanezumab is expected to be indicated initially for mild Alzheimer’s disease, based on the design of the clinical trials. However, Datamonitor Healthcare believes that physicians will be willing to prescribe solanezumab in earlier, prodromal patients given the potential utility of immunotherapies in this population, provided that prodromal AD can be accurately diagnosed. The availability of amyloid-beta positron emission tomography (PET) imaging and the likelihood of reimbursement, should there be sufficient therapeutic justification, would support identification of the early stages of the disease and treatment accordingly. There will be a rapid expansion of the value of these indications starting in 2018. (See Exhibit 2.)

The market for treating moderate Alzheimer’s disease is only expected to grow at a CAGR of 2.74%, with fewer new drug approvals in this population, and no appropriate disease-modifying therapy. On the other hand, the market for severe Alzheimer’s disease will decline at a CAGR of –5.98%. With no new drugs approved in this population, the severe AD market becomes especially vulnerable to the ongoing brand erosion by generics.

For more information on Datamonitor Healthcare's September 2016 reports, "Alzheimer's Disease Forecast" and "Alzheimer's Disease Pipeline," contact [email protected].