Biopharma 2018: Is There Still A Place For Pharma In The New Health Care Economy?

Executive Summary

2018 will be a time of transition in health care, when biopharma’s counterparts in adjacent industry segments scale up in a radical redesign of their traditional business models. Biopharma is not moving as quickly, and it confronts a strategic dilemma on how to address the prospect of a much more powerful set of rivals in the ongoing battle to own the patient experience in medicine.

- For the new year, In Vivo offers six areas where the pharma C-suite can counter health policy and system bottlenecks by building to excel.

- Cooperation within biopharma to improve safety signals will be crucial in maintaining public confidence in the new gene-based therapies now entering widespread clinical use. Success for these transformative therapies will necessitate – and drive – long overdue changes in approaches to market access, value and reimbursement.

- So what? The push by health care players outside biopharma to dominate the entire health vertical through size, scale and reach might backfire, imperiling the essential relationship to patients as well as incurring the wrath of trust-busters and other industry regulators.

The key challenge confronting biopharma in 2018 is the disconnect between an abundance of transformative science and a hidebound commercial and regulatory model that continues to place barriers to making the right medicines accessible to patients who need them. It’s a structural problem in the delivery and financing of health care overall, but one that impacts biopharma disproportionately by adding to the cost of drug development, denting the benefits of innovation and diminishing the industry’s reputation as a force for social good.

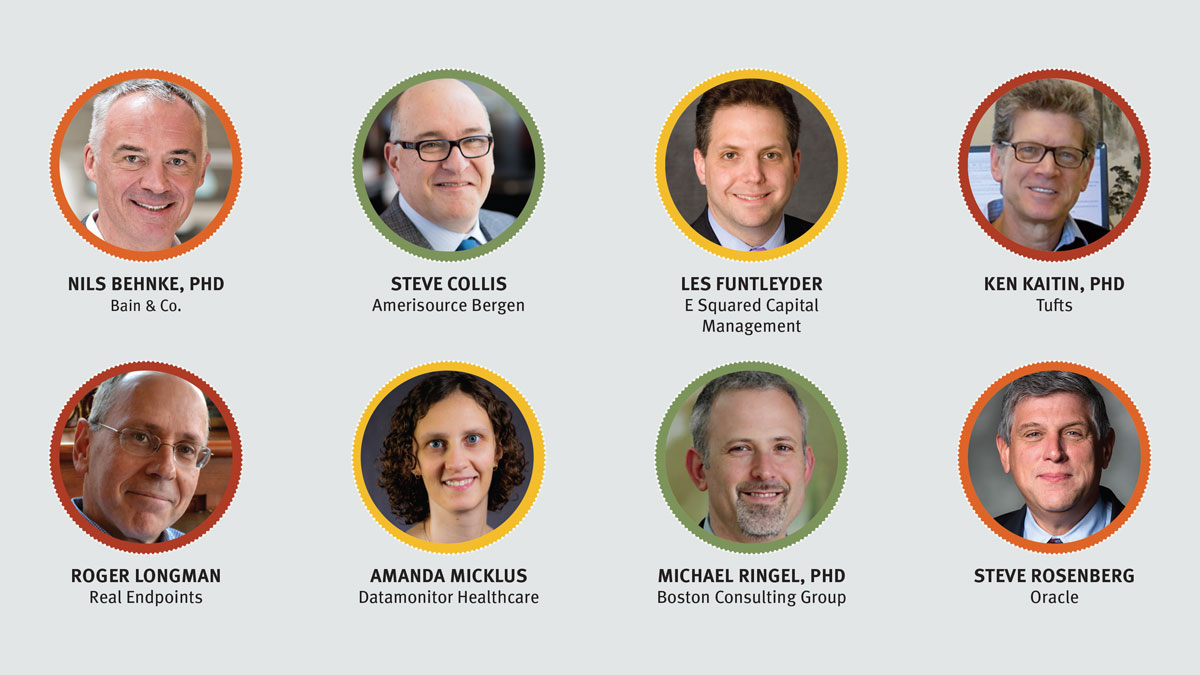

Solving for the imperfections that guide institutional behavior – can human health provision ever be anything but “messy”? – will dominate the commercial and policy agenda for biopharma in 2018. In Vivo Editorial Advisory Board (EAB) member and health care portfolio manager at E Squared Capital Management Les Funtleyder describes current attitudes in the C-suite as one of “disembodied anxiety” fueled by a host of factors, including pricing pressures; restive patients; the ascent of adjacent players like Amazon; state government transparency mandates; the soaring cost of deferred IT investments; compliance and anti-trust exposures; and those generic and specialty segment train wrecks. Overlaying all is the market churn caused by the consolidation now taking place in other health industry verticals. Says Funtleyder, “The consensus is the biopharma business model has to keep adjusting in line with these uncertainties – but how, and to what end?”

A mandate to change must first account for the remarkable persistence of traditional rules of engagement. The diktats of drug development feed that sedative called complacency. The “gold standard” for drug approval – the randomized clinical trial – remains largely as it was in the 1940s. The P&R process is complex, arbitrary and almost completely non-transparent, while information – biopharma’s greatest single untapped asset – is plagued by the contradictions, duplication and missing links of a disaggregated world of “data islands” with little connection to the actual experience of patients. Biopharma’s own promotional practices, at least in the US, seem rooted in a bygone era of unconstrained budgets, following a strident “push” model that is often tone deaf to contemporary notions of clinical value or medical need. Turn down the volume on a TV ad for psoriasis, related auto-immune disorders and other heavily promoted drugs and one might think the subject is sex, not science.

Meanwhile, regulations and markets continue to incentivize R&D resources within an increasingly narrow band of high-promise therapies. But are there really any “niche plays” left among the more than 1,000 trials now underway in immuno-oncology? Is all that investment heading toward a cliff of clinical indistinguishability while the hardest problems of public health – like Alzheimer's disease – remain unsolved?

Featuring Analysis From:

No Safety In The Middle Lane

Taken together, these institutional realities are slowing biopharma’s necessary transition as an integral component of the health care ecosystem. The stakes going forward are high. The alternative is being positioned as a high-cost outlier vulnerable to challenge from adjacent industries with a loss-leader consumer orientation or from emerging geographies such as China that offer a cheaper business model. In the competition among health care providers to “own the patient,” biopharma risks being marginalized as medicines access becomes the province of powerful third parties with a different, budget-driven perspective on confronting disease.

In the competition among health care providers to “own the patient,” biopharma risks being marginalized as medicines access becomes the province of powerful third parties with a different, budget-driven perspective on confronting disease.

As US health care struggles to adapt to an aging population (the 65+ cohort has risen 40% since 2000, to 50 million people), soaring costs (at $3.3 trillion in 2016, US annual health care spend now exceeds the entire GDP of the UK, the world’s fifth largest economy) and rising public expectations (15 million new enrollees in the public Medicaid entitlement program since 2013), most service providers outside biopharma are aggressively repositioning their businesses. The imperative is to manage cost exposure risks by controlling the patient journey through the health system, diversifying lines of business and capturing more of the value that leads to better outcomes for patients – and improved returns to shareholders.

Examples of this push toward integrated channel consolidation include moves by insurers to purchase home care and rehabilitation vendors as well as to enter the pharmacy benefits business. (See Exhibit 1.) The aim is to supplement the processing of claims with adherence and prevention services that provide direct line of sight over costs incurred by their covered populations. The classic contract research organization (CRO) is morphing into the contract commercial organization (CCO), acquiring analytics and big data providers to fire up its existing strengths in expediting drug development. Hospitals, confronting opposition to an absurdly expensive “high-touch” delivery model, are bulking up to secure regional market dominance while acquiring specialty drug pharmacies. The goal here is to increase purchasing power through scale and reach and provide more care on a cheaper outpatient basis. Physicians are relying on incentives in the 2010 Affordable Care Act (ACA) to create integrated delivery networks (IDNs) that operate like a closed HMO in providing employer-based populations with both prophylactic and preventive care, at a fixed per-patient cost, usually on a long-term basis – where patient outcomes can be tracked, measured and justified to payers.

Exhibit 1

Summary Of Recent Health Care Service Industry Deals

|

Deal Date |

Deal Category |

Acquirer |

Target Company or Asset |

Deal Value |

Status |

|

Dec. 2017 |

Asset Purchase |

UnitedHealthcare |

Primary and urgent care outpatient facilities, Da Vita Inc. |

$4.9bn |

Pending |

|

Dec. 2017 |

Asset Purchase |

Humana |

Home care and hospice services, Kindred Health |

$4.1bn |

Pending |

|

Dec. 2017 |

M&A |

Advocate Health Care |

Aurora Health Care |

Debt free, non-cash transaction |

Pending approval as Advocate Aurora Health |

|

Dec. 2017 |

M&A |

CVS Caremark |

Aetna Insurance |

$77bn |

Pending |

|

Nov. 2017 |

M&A |

McKesson |

Rx Crossroads |

$735m |

Completed |

|

Oct. 2017 |

M&A |

Express Scripts |

eviCore Healthcare Inc |

$3.6bn |

Completed |

|

Sept. 2017 |

M&A |

Walgreens |

Rite Aid Pharmacy |

$4.4bn |

Completed |

|

July 2017 |

Private Equity |

KKR & Co. Internet Brands |

WebMD |

$2.8bn |

Completed |

|

May 2017 |

M&A |

Thermo-Fisher |

Patheon CDMO |

$7.2bn |

Completed |

|

April 2017 |

Asset Purchase |

Cardinal Health |

Patient care, deep vein thrombosis, and nutrition insufficiency LOB, Medtronic PLC |

$6.1bn |

Completed |

|

Oct. 2016 |

Private Equity |

Blackstone Group |

TeamHealth |

$6.1bn |

Completed |

|

Aug. 2016 |

Private Equity |

Advent Int’l VC |

InVentiv Health |

$3.8bn |

Completed; relaunched as Syneous Health on 8/1/2017 |

Medtrack | Pharma Intelligence, 2018

Finally, distributors are leveraging their logistical strengths to occupy a crucial space in the delicate, time-sensitive transfers of living human cells that form the supply backbone for the newest gene-based drug therapies. “We are now innovating among the best,” Amerisource Bergen Corp. CEO Steve Collis tells In Vivo in explaining his company’s recent selection by Novartis AG to coordinate logistics for the first FDA-approved gene-modified cell therapy, Kymriah (tisagenlecleucel-t). “It’s another mission-critical activity that biopharma cannot do alone.”

Perhaps the biggest example of the urge to control is the move by a network of religious-affiliated hospitals and independent IDNs to address chronic supply shortages and price hikes in generic drugs by entering the business directly, either as a non-profit purchasing cooperative or direct manufacturer. (Also see "Provider Consortium Will Try 'DIY' Solution To Generic Shortages, Pricing" - Scrip, 18 Jan, 2018.) “It’s no surprise the providers are seeking a solution to these generic market improprieties,” comments Les Funtleyder. “Less certain is whether this kind of arrangement will actually work to deliver the purchasing stability hospitals seek. Quite frankly, the federal government could have fixed the problem some time ago – we have a Strategic Petroleum Reserve for oil so why not a Strategic Drug Reserve that can be mobilized quickly to tackle the supply chain problems and the opportunity this provides for price gouging?”

Going Small

Ironically, many drugmakers have bucked this trend to bulk up by “going small,” focusing their research on narrow cohorts of patients with rare diseases and no alternative means of treatment. Originally the province of biotech, big pharma has also moved aggressively into the rare disease space. These “orphan” drugs offer inventors a greater measure of control over development and marketing costs due to an accessible and highly engaged community of patients and prescribers. The challenge is to justify the high price points required to achieve a reasonable ROI from a highly selective patient population and to fund the add-on indications that expand market potential and increase sales. (Also see "Orphan Drug Pricing And Reimbursement: Challenges To Patient Access" - In Vivo, 15 Nov, 2017.)

Last year, federal government incentives to promote rare disease research were scaled back as this specialized therapeutic field grew more crowded. As a result, investor attention is slowly returning to treatments for diseases for large populations. Amgen Inc., the biggest biotech, has made this point clear in recent meetings with investors. Thinking small does have its limits. But the real issue is the financial stakes in market acceptance in 2018 are much higher than when follow-on medicines aided by a crush-it-all field force were sufficient to drive scrip sales. More population-based options that reach beyond the current standard of care must be pursued to grow revenues.

Then there is the elephant in the room called Amazon. With a soaring market cap of more than $600 billion and a willingness to confront and out-brand any rival on price, Amazon now controls one-half of all online retail sales in the US, notching annual sales of $136 billion in 2016, which places it among the top ranks of health industry leaders like CVS Health Corp./Caremark Rx Inc., McKesson Corp. and UnitedHealth Group Co. But where Amazon chooses to engage (the retail OTC/HBA or online pharmacy space most likely, facilitated by its 2017 acquisition of the Whole Foods supermarket chain) is less important than the impact of its transparent, loss-leading price model.

Disruptors And Accelerants – It's Fire Just The Same

In a tightly regulated, high-barrier sector like health care, transparency is the biggest disruptive force of all. It’s a market-based equivalent to government price controls. That’s because, when producers prove reluctant to explain the difference between list price and net price, transparency exposes the role of every player in a transaction – what they do and what they get in that passage of product to patient. The potential is there for an interloper such as Amazon to use that transparency to render the middleman superfluous, driving down costs, the impact of which is going to be based on where you sit in the health care supply chain. And recent examples from the high-tech start-up world (Uber, Airbnb) show that you can transform an entire industry without making the product that defines it. That puts a damper on the idea that core competence always clears the field.

Recent examples from the high-tech start-up world (Uber, Airbnb) show that you can transform an entire industry without making the product that defines it. That puts a damper on the idea that core competence always clears the field.

Like the entry of new rivals, technology also demands biopharma’s attention. IT capabilities in health care are growing at a pace equivalent to progress in our understanding of the biological and genetic origins of disease. In fact, the spread of useful information fueled by technology provides the rationale – and the means – for the moves by so many health care players into businesses outside their traditional base.

It’s another disruptive trend that will gather strength in 2018 as a range of new data management and eclinical platforms come on stream, particularly for clinical trials and postmarketing surveillance. The most important of these are systems that can integrate multiple streams of data and eliminate redundant processes to guide complex decisions on key aspects of the drug development and launch process, from setting the right trial endpoints, finding and analyzing the most relevant information from patients, even expediting the design of human subject studies conducted on a less costly “virtual” basis – all in an accessible but highly secure cloud environment. Oracle Health’s recently launched Clinical One platform is but one example of this.

“More than ever, analytics rule the world of medicine. Yet many in biopharma still rely on legacy IT devised in the chemistry, small-molecule era,” Oracle SVP and general manager Steve Rosenberg tells In Vivo. Upgrading data infrastructure will be a major expense for the industry through the end of the decade, but we believe the investment will more than pay for itself through higher productivity at every stage of the R&D process and the ability to bring more drugs to market faster for patients waiting in the balance. Most important, creative application of these integrating technologies is critical if drugmakers are to create the necessary regulator and payer confidence in real-world evidence [RWE] that will drive a drug’s value proposition in the future,” Rosenberg says.

Taken together, the spurt to restructure that dominated other parts of the health ecosystem in 2017 has left biopharma a bit blindsided. All the trends point to health care becoming a more consumer-oriented business, with the patient bearing more of the cost of care. Hence, the different health verticals all want to “own” the patient experience by doing a variety of things, geared to solutions as opposed to products.

Nevertheless, biopharma continues to pursue its singular model of technology “push.” Says Bain partner and a leader in the firm's Health Care and Strategy practices Nils Behnke, PhD, “It’s still the standard among many big pharma to develop a new technology, obtain approval and create a product marketing campaign with heavy promotion to physicians, often based on a product differentiation strategy where there is already an existing high standard of care. This traditional approach is considered by many stakeholders to be reactive and adversarial. The better approach is to develop superior disease-state solutions around a new drug, which requires biopharma companies to pursue a strategy of market leadership in therapeutic categories and to build new capabilities.

This is not to say that biopharma is completely disengaged. On the one hand, collaborative efforts between drugmakers and other parts of the health sector are becoming more common in diabetes, where payers hold most of the cards on price and market access. Segment leaders Eli Lilly & Co., Merck & Co. Inc., Novo Nordisk AS and Sanofi have no choice but to position themselves as integral parts of a full-service care delivery platform, beyond the drug itself. It’s expensive but necessary in addressing the demands of payers for better outcomes in a prevalent condition characterized by numerous co-morbidities.

On the other hand, industry efforts to create a new class of injectable lipid-lowering drugs (the PCSK9 inhibitors) appear to have misread physician and patient sentiments on what constitutes a real advance against standard of care – and how much that advance should cost. Sales of PCSK9’s have posted far below initial launch projections, suggesting that biopharma still has trouble holding its own in a conversation to establish value at the patient point of care. But leading that conversation is going to be far more important as out-of-pocket drug costs for patients increase along with the clout of commercial payers who administer benefits and set plan deductibles.

Breaking The Siege – Six Strategies To Succeed In 2018

So what will biopharma do? Will “strategy accelerators” like tax reform force big pharma off the fence to start investing big in those high-tech partnerships that some observers see as transformative to the industry’s basic mission? For big pharma, it’s a huge bet to shift direction: from investing in individual drugs to treat a disease to building customized, complex data sets that map the underlying genetic profiles of individual patients, resulting in interventions – not exclusively drug-based – that reverse or prevent the disease itself. To achieve that, everything – from basic discovery to reimbursement – must change.

Where To Focus In 2018

- M&A is back on the table; take advantage

- Federal legislative inaction: a mixed bag for pharma

- Working with a re-energized FDA

- Define and deliver value

- Manage a controlled rollout for advanced therapies

- Preserve the US innovation climate

The good news is that in 2018 the stars are aligned to give drug companies space to pause and take some of these truly strategic steps – to reinvigorate their business models and move innovation forward in ways that matter to patients. In Vivo discussions with a cross-section of industry experts suggest a C-suite focus on the following agenda items.

Deal-making: Back On The Table

In 2018, one should see clarity restored to the M&A environment for biopharma after a year of decidedly mixed signals. Informa’s Strategic Transactions finds that although the value of acquisitions in 2017 rose to $208 billion from 2016’s $104 billion, the number of deals went down significantly (97 in 2017 vs. 123 in 2016). Clearly, the majority of investors chose to sit tight while the new US administration pursued the first comprehensive overhaul of the corporate and individual tax regime since 1986.

Passage of the Tax Cuts and Jobs Act (HR 1) on December 20 removes the uncertainty, although the impact from adoption of the territorial tax structure used in other industrialized countries as well as reduction of the basic corporate rate on profits from 35% to 21% will vary depending on a company’s geographic exposure and the tax treatment of intangible assets like IP. A special low rate on the repatriation of industry cash parked abroad from earnings outside the US – estimated at more than $170 billion – gives companies substantial room to maneuver, from pursuing large-scale mergers, a relatively rare event so far this decade, to targeted, bolt-on asset acquisitions, license and partnering ventures as well as to straightforward financial instruments like dividend raises and share buybacks.

“Conditions are ripe in 2018 for big pharma to do some truly transformative deals,” says Boston Consulting Group’s managing partner for life sciences (and In Vivo Editorial Advisory Board member) Michael Ringel. “There are convincing arguments that mergers are a necessary way to take out waste and deliver operational efficiencies while doubling the contribution from complementary scientific talent and expertise. It’s an opportunity to refresh your strategic focus and avoid that institutional inertia. Yes, the mechanics of a big merger can be as difficult as changing the tires on a car while it’s still moving. But there is also opportunity to refresh your strategic focus and avoid the long-term consequences of institutional inertia, with the best combination of people, systems, products and science, to cross-sell and introduce more diverse products to the market.”

Aiming for more size and reach may work as a defensive play for biopharma as other health sector verticals scale up to become more formidable price negotiators. Industry simply has to do more to gain access to all those covered lives.

Amanda Micklus, Informa Pharma Intelligence principal analyst for Datamonitor Healthcare, suggests that big pharma will resist thinning its ranks through large-scale combinations equivalent to the Pfizer Inc./Wyeth ($68 billion) and Merck & Co./Schering-Plough Corp.($41 billion) mergers of a decade ago. “I think we will see many more asset-building acquisitions directed to highly specialized pipeline and therapeutic category objectives. Filling geographic gaps in the business growth plan is another important goal. The consensus remains strong that the big mergers created problems of complexity and cultural fit and ended up doing little to boost R&D productivity and increase the pace of commercialization for new products. This year, there are no objectives more important than these two, and not just for big pharma but for specialty and

Research conducted by professional services firm EY on 278 biopharma transactions between 2010 and 2017, released at this month’s JP Morgan 36th Annual Healthcare Conference, concludes that targeted bolt-on transactions produced a higher return to shareholders than so-called transformative mergers valued beyond $10 billion. “What we found was that, despite the risks of patent expirations, negative clinical trial outcomes and unfavorable reimbursement decisions, bolt-on transactions showed a slight edge compared to the transformative deals over the survey period,” Arda Ural, PhD, partner in EY’s Life Sciences Transactional Advisory Service, tells In Vivo. “That’s because the biggest deals involve operational discipline, dexterity in cultural change management and effective employee communications, the benefits of which only show up over time – two or three years at least.” (Also see "No Seismic Shifts As Torrential Rain Dampens JPM Jamboree" - In Vivo, 21 Jan, 2018.)

Biotechs share the same deal-making perspective, as they are increasingly looking for big pharma’s help in advancing their most promising compounds toward commercialization. Completing a successful clinical trial requires expertise they don’t have. Start-ups are more open to bolt-on buyouts and partnerships if the combination helps fill this gap.

All these converging factors ensure the biopharma business development function will be kept busy in 2018 putting tax reform’s additional cash reserves to productive use.

Finally, biopharma deals will be influenced by fresh cues from the FDA seeking to drive innovation in hot areas like gene therapy, neurodegenerative disorders and regenerative medicine. These and other novel treatment pathways – including next-generation drug-devices – will benefit from an agency priority in 2018 to create more clarity in testing and reduce time to market.

All these converging factors ensure the biopharma business development function will be kept busy in 2018 putting tax reform’s additional cash reserves to productive use. The range of interests will expand as senior management asks for more small, “kick the tire” partnering in digital, big data analytics and machine learning. One precedent to start the year is Roche’s deal with GE Healthcare on a new digital diagnostics platform to apply advanced analytics to workflow solutions and apps that support clinical decisions in oncology and in the ICU space, where machine learning will seek to predict patient complications before they strike. (Also see "GE And Roche Join Forces In First-Of-Its-Kind Tech Pact" - Medtech Insight, 8 Jan, 2018.)

Significantly, however, many VC players are still skeptical of digital as the "bird in hand" that will revive the biopharma formula for growth. VC money is not flowing into digital at this point, although the convergence of biology and engineering that digital health represents remains attractive. The wait is on this year for evidence that patients will adopt the behaviors that enable digital health to work in line with expectations.

Industry Policy And Politics: Out To Lunch?

Government usually weighs heavily in biopharma’s strategic calculations, but 2018 is likely to prove the exception. A feeble effort around industry self-regulation begun last year has been sufficient to prevent legislation to introduce transparency and negotiation on drug prices, and no action by Congress or the Trump administration can be expected this year. In contrast to the massive change taking place on the commercial front, virtually every aspect of government health care in the US is gridlocked. It reflects a larger ideological conflict about whether access to basic health services is an individual responsibility or a shared commitment of society. The US remains the only industrialized country that has failed to resolve this fundamental value question. Yet the surprising trend is how legislative inaction is actually supporting the growth of publicly sponsored health care programs like Medicare and Medicaid, which are forecast to account for 47% of all US health spend by 2025 – it’s entitlements by default.

The point is partisanship has become an enduring feature of the federal landscape. This means that while little of substance gets done – in industry quarters, that’s often seen as a good thing – there is also pervasive uncertainty about the long-term direction of public policy toward biopharma. If, as seems likely, control of Congress shifts to the Democratic Party in the November mid-term elections, biopharma will face renewed efforts to introduce price negotiation for Medicare Part D drugs and restore key elements of the 2010 Obamacare health reform law eviscerated last year by the current GOP majority. The pendulum swings both ways, which is never good for a business that must make big bets on capital that pay out only over time.

In addition, gaping deficits from the new tax reform law will reinvigorate congressional budget hawks, making it harder to reauthorize popular benefit programs like the Children’s Health Insurance Program (CHIP), which supports reimbursements for a surprisingly high proportion of the industry’s most innovative new medicines in the pediatric space. Fiscal pressures may also stimulate regulatory actions to narrow tax subsidies for biopharma’s drug compliance and support programs as a promotional tool rather than a legitimate service to patients. Tax law can not only give, it can also take away.

What biopharma must do in such a divisive environment is to cultivate new audiences outside the K Street “swamp” and go deep on CEO demonstrations of public “authenticity” – the new coinage for reputational enhancement in an era where even facts are labeled "fake news."

What biopharma must do in such a divisive environment is to cultivate new audiences outside the K Street “swamp” and go deep on CEO demonstrations of public “authenticity” – the new coinage for reputational enhancement in an era where even facts are labeled "fake news." It’s also worth noting that business and the military remain the only societal institutions deemed by the polls to be in working order. It’s also wise to stay local in affiliations, choosing strong national and regional managers capable of helping HQ interpret the political tea leaves. A global corporation deprived of this intelligence is effectively stateless when trouble arises.

FDA’s Friendly Persuasion

The FDA is the go-to destination this year in addressing fundamental supply chain issues neglected by the political branches of government. Under Commissioner Scott Gottlieb, MD, the FDA is tackling topics such as industry competition, where it is reviewing current rules on patents and exclusivity jointly with the Federal Trade Commission (FTC); pricing and access to medicines, where it has launched a vigorous effort to anticipate and prevent single-supplier situations and, through stepped-up abbreviated new drug application (ANDA) approvals, push more competitively priced generics and biosimilars on to the market; and innovation, in the form of increased flexibility in approving novel new medicines on the basis of demonstrated improvement against standard of care. Additional forms of evidence beyond the RCT will, in certain cases, be accepted to demonstrate such improvement. The FDA has also pledged to take better account of what patients and other stakeholders really value in the medicines they take in the clinical setting.

Finally, the FDA is actively encouraging industry-led partnering initiatives to share more trial data and cooperate in the analysis of adverse events, particularly in the sensitive cancer space. Overall, the agenda suggests faster times to drug approvals and a willingness to take account of unmet patient need in the certification of trial endpoints.

One bright spot in the legislative mix is the 21st Century Cures Act (Public L. 114-255), a true bipartisan piece of legislation enacted by Congress in December 2016. A significant portion of the FDA’s work in 2018 will be in providing guidance for biopharma on key pro-innovation provisions of the law. This will include measures to advance NDA reliance on RWE and other patient-centered alternatives to the traditional RCT, and providing more support for a positive, risk-based approach to use of digital technologies for both platforms and products. The act underscores how good legislation is not only facilitated when both Democrats and Republicans are engaged, but it also tends to last as well. The FDA is capitalizing on the bipartisan vibe by offering itself as an honest broker between the industry and other stakeholders, especially organized patient groups.

Value: It’s Game On

All drugmakers acknowledge the importance of establishing a new medicine’s value to payers beyond the standard clinical anecdotes and testimonials from KOLs. But the will to do so continues to face numerous barriers. These include cultural complacency and conservatism within the biopharma enterprise, the short-term orientation of investment decision-making and the absence of a broad institutional mandate to set rules for defining value, along with the tools to measure it.

Private payers are often disinterested in risk-sharing deals due to their emphasis on managing costs through short-term, one-off interventions. Government continues to send out mixed signals. It has endorsed value constructs as an administrative priority linked to quality but has done little to alleviate mandated rules of behavior that make value-based contracting inherently risky. These include:

- regulatory requirements, especially the murky rules on engaging with payers on P&R before a product receives full licensing approval;

- exposure to violation of the Medicaid “best price” rule, including prosecution for price collusion, resulting in the possibility of hefty fines and denial of access to covered populations; and

- anti-kickback rules that may define industry investments in patient support programs for complex therapies as an illegal, anti-competitive promotional inducement.

Exemptions that minimize the legal exposure for participants in any risk-sharing agreement could serve as a useful first step in incentivizing the push for value. Yet, with the exception of an FDA move to legitimize that broader dialogue with payers prior to authorization, government action to “de-risk” value-based contracting is unlikely this year. “Government is less relevant today as a factor in this transition,” observes Roger Longman, CEO of Real Endpoints, a market access consultancy, partner to Informa Pharma Intelligence and member of the In Vivo EAB. “The commercial segment is much further along, but it too confronts significant challenges. One is misreading their audience: drugmakers often presume that payers are uninterested in negotiating value, when in fact payers are desperate for new approaches to managing their costs and maintaining credibility with clients responsible for millions of covered lives.”

At the same time, however, payers are fighting a largely unseen pitched battle with drugmakers on the basic issue of access to innovative specialty medicines. “Payers and providers are looking for ways to extract every imaginable discount from the manufacturer aimed at preventing enrollees from being moved to low-cost meds once exclusivity ends,” says long-time industry managed care expert Mason Tenaglia. The list includes blocking co-pay coupons as well a new twist recently introduced by the leading pharmacy benefit managers (PBMs): comprehensive “accumulator” programs designed to counter any manufacturer incentive to help patients reduce deductibles and other out-of-pocket costs in their drug benefit. PBMs are also fighting a CMS proposal to pass a portion of drug rebates extracted from the manufacturer on to patients to reduce the cost burden. "Such tactics are a negative distraction to reaching that larger consensus around value-based solutions to drug costs,” Tenaglia adds.

"What is the relevant value metric for a long-term cure or a technology that makes the prospect of disease irrelevant to the patient?" – Roger Longman

An additional strategic question likely to surface this year is how the arrival of complex curative and preventive technologies like gene therapy will shape discussion among drugmakers and payers on the very definition of “value” in health care. (Also see "New Payment And Financing Models For Curative Regenerative Medicines" - In Vivo, 24 Jul, 2017.) Adds Longman, “These are new science platforms that extend into areas where the traditional biopharma business model has little familiarity. What is the relevant value metric for a long-term cure or a technology that makes the prospect of disease irrelevant to the patient? Much of the patient care experience will be shaped by a cellular engineering process rather than a one-off experience with a drug whose technology is well-known. So there’s a new dynamic at work here in how society itself defines value.”

Nevertheless, numerous experiments to breach the divides are underway this year – the long slog toward a value-driven health care system continues. One project that bears watching is a multi-stakeholder initiative launching this month called LEAPS (Learning Ecosystem for Accelerating Patient-Centered and Sustainable Innovation) organized by the Massachusetts Institute of Technology's Center for Biomedical Innovation. With backing from the state of Massachusetts and three big pharma companies – Merck, GSK and Sanofi – LEAPS will seek to build a treatment protocol, evidence base and value measurement tool that links providers, payers, pharmaceutical and IT firms, regulators and academic researchers around a series of functionally relevant incentives, all geared to achieving patient-centered outcomes in a designated state-wide population with a specific, yet to be chosen chronic disease.

“Over the next year, the plan is to create a shared protocol for defining and delivering value, at three levels of engagement: (1) new product development; (2) regimen/treatment development; and (3) clinical disease management, using RWE,” center director Gigi Hirsch, MD, tells In Vivo. She notes that the LEADS project is precedent-setting by attracting the participation of all the principal players in the Massachusetts biopharma ecosystem. “We’ve got the commitment of the right people in the state to make this work as a template for the value-driven system of the future,” Hirsch says.

Adapting To The Demands Of New Science

As more advanced, gene-based therapies come on-stream this year, biopharma will need to understand and communicate the complex challenges of moving these technologies from bench to bedside. Instead of the standard hyped-up launch, these new products demand a “controlled rollout” approach due to the potential for severe side-effects (like cytokine release syndrome) in some patients. Administration of these technologies safely to patients carries obligations that include setting up treatment centers at academic teaching hospitals to monitor those receiving therapy, and retention of hundreds of trained professionals with expertise in everything from handling live cells and tissues to courier logistics, dosing, anesthesia and psychological counseling. There are also the details of coordinating access to hospital ICUs – where reserving a single bed to cover a sudden adverse patient episode can cost upwards of $10,000 per day, even if it’s not used.

The opportunity cost of a controlled rollout is high but prudent. Only a few deaths from the new CAR-Ts and related cell transfer therapies could rattle regulators and payers and stop these advances from progressing further into the clinical setting, where active observation can control for these incidences and remove them as a barrier to care. Nevertheless, it’s an unprecedented challenge of learning by doing. The lesson here is that extreme care must be taken if these complex actions across multiple potentially hazardous supply and manufacturing touch points are to earn the confidence of regulators, providers and payers. On such confidence depends the approval of additional gene therapy applications and a larger, sustainable market for these technologies, extending forward to a wider patient population.

Extreme care must be taken if these complex actions across multiple potentially hazardous supply and manufacturing touch points are to earn the confidence of regulators, providers and payers.

The year 2018 will begin the testing time for this essential transition. Recognizing the high stakes in the safety of next-generation immuno-oncology medicines, six major biopharma companies active in the space will launch a project next month with the non-profit open access to clinical trials group, Project Data Sphere. In the project, Project Data Sphere will work with all six companies in applying machine learning applications to track and analyze side effects from immuno-oncologic drugs now on the market, including the major checkpoint inhibitors. “Our material will be shared as de-identified open access data sets to help the companies, researchers, regulators and other interested parties compile evidence necessary to control these events and improve the safety and reliability of the newest cancer drugs,” says Project Data Sphere CEO Martin Murphy, DMedSc, PhD. The first condition to be reviewed is myocarditis events associated with checkpoint inhibitors (e.g. PD-1 and PD-L1), followed later by pancreatitis and neuropathy. (Also see "Free And Open: The Next Wave In Clinical Trial Data?" - In Vivo, 10 May, 2017.)

Preserving The US Innovation Ecosystem

For 75 years, the US has led the world in inventing and commercializing new medicines. Generous government funding of basic research; strong academic institutions combining world-class talent with an entrepreneurial bent; an independent, rules-based regulatory infrastructure; and extensive private capital with a high-risk/high-return mind-set continues to keep the US on top. But that is not an indefinite guarantee.

“Some significant vulnerabilities, largely self-inflicted, are raising concerns about the future of US medicines innovation,” contends In Vivo EAB member Ken Kaitin, PhD, professor of medicine at Tufts University and director of the Tufts Center for the Study of Drug Development. “You have a long-term decline in the number of federal grants for disease research, which has reduced opportunity for younger researchers with promising ideas worth commercializing in concert with industry. But the most ominous trend is the backsliding of the Trump Administration on immigration. “The ‘America First’ polemics is discouraging qualified foreign researchers from coming to this country for study and employment. As a result,” Kaitin says, “academic institutions like Tufts are experiencing a decline in their talent convening power, which has negative consequences for keeping our innovation edge against emerging competitor countries like China going forward.”

Thus 2018 offers an opportunity for biopharma to re-examine its human capital strategy from a fully globalized perspective. Given the aging US population, a souring national debate on inclusion and the increasing importance of new skills in an era of rapid technological change, it’s imperative for biopharma to raise the ante on talent recruitment and retention. The urgency is accentuated by the planned reduction in H1-B visa quotas for high-skill foreign workers and as image issues send applicants to other countries seen as more welcoming to immigrants. (Also see "Future-Proofing Human Capital: Does Biopharma Have The Right Stuff?" - In Vivo, 31 Jul, 2017.)

Reviving Health Care’s Think Tank

Yes, human ingenuity determines what really matters in health care, which is mounting the best challenge possible against the endless trajectory of disease. It’s fitting to end In Vivo’s “year beginning” review with a reference to the passing of three prominent economists in 2017 who, through their theories and writings, shaped how the world looks at medicines and health care through much of the 20th century and right through to today.

- Kenneth Arrow, PhD (born 1921) depicted health care as unpredictable and rife with market failures, including a yawning information gap where producers (the physician) know more than the consumer (the patient). His work continues to fuel the premise that everything from insurance to prescription drug testing must be subject to strict government regulation.

- William Baumol, PhD (born 1922) developed the “Baumol cost disease” theorem that holds health care costs are destined to rise without the normal productivity gains that occur in goods-producing sectors because it is a service built largely on labor, an intangible commodity that is harder to measure than widgets.

- Uwe Reinhardt, PhD (born 1937) invented the role of influential activist economist able to spin theory into policy, an example of which was his success in making the individual mandate in health insurance a pillar of the 2010 Affordable Care Act. He worked both as an advocate and an insider, interacting frequently with biopharma companies, where he argued for their support on more transparency in drug pricing. Reinhardt convinced Merck & Co. at one point to endorse the reference-based pricing system of his native Germany.

The passing of these three innovators in ideas speaks to the question: is there a successor generation with the same potential to influence how decision-makers outside the academy, in business and government, look at health care, not just in 2018, but for the decades to come? The agenda is urgent and it does not change. A good health system is one that balances the socializing goals of inclusion, access and cost against the acquisitive animal spirits of invention. It remains an ideal, but disease is the universal experience – there is no opt out.