Beyond The Watershed: Gene Therapy Investment And Promise

An Interview With Janet Lambert, CEO Of The Alliance For Regenerative Medicine

Executive Summary

Janet Lambert, CEO of the Alliance of Regenerative Medicines recently spoke to In Vivo about the tremendous levels of investment the cell and gene therapy industries are attracting, as well as reasons why Europe excels at incubating advanced product development.

Question: what do the words Nightstar, Spark and Vivet have in common? The answer: all the names of companies working on development strategies for gene therapies that, together, have piqued the interest of big pharma to the tune of almost $6bn within the last 12 weeks.

Biogen Inc. recently announced it would pay $877m for Nightstar Therapeutics PLC a deal that will give it access to the gene therapy developer’s expertise in retinal diseases. Elsewhere Roche marked its territory at the end of February by agreeing to pay almost $5bn for Spark Therapeutics Inc. to get hold of inherited blindness drug Luxturna (marketed in Europe by Novartis AG and in the US by Spark), and a few hemophilia A candidates.

Pfizer Inc., which has a history of bolting on gene therapy assets, has most recently paid $51m for a 15% share in French gene therapy company Vivet Therapeutics, which is developing a new program for Wilson disease, a rare and potentially life-threatening liver disorder that causes copper poisoning. Pfizer could pay up to $635.8m, including the option to acquire Vivet outright, under the companies’ agreement, after Phase I/II data for lead asset VTX-801 is available.

These three deals are the latest incarnations in big pharma’s quest to establish strongholds in this emerging area by investing heavily in companies and products that have disease-modifying potential. Investors too, are warming up considerably to the potential return on investment cell and gene therapies can potentially provide. 2018 saw a huge uptick in investment in gene therapy companies, but the path to efficient manufacture and commercial success for these products is still far from clear.

New research from the Alliance for Regenerative Medicine (ARM) found that, globally, companies active in gene and cell therapies and other regenerative medicines raised more than $13.3bn in 2018, a 73% increase over 2017. This financing surpassed figures from 2015, which according to ARM’s CEO Janet Lambert, was a “watershed year” in terms of investment in the sector when it attracted over $10bn in financing.

“The past few years have seen steady year-over-year uptick in investor interest in financing cell and gene therapies – this sector continues to demonstrate sound and exciting scientific and clinical progress, several with astounding and meaningful patient response,” Lambert told In Vivo in an interview.

Several of these therapies have made it to market in the US and Europe, and both public and private payers have shown at least some willingness to engage in innovative financing and reimbursement approaches. These strides give investors the confidence that scientifically, these technologies are promising, and in some cases proven. “Clinically, these products have and will continue to provide significant improvement over current palliative approaches, and in some cases, provide a viable, durable treatment option where perhaps there was none,” Lambert said.

Not only was last year a huge moment in terms of venture capital investment, it was also a standout year for IPOs. To name a few but not all; Allogene floated for $372.6m, Rubius Therapeutics for $277.3m and Orchard Therapeutics for $225.5m. Secondary financing also found a responsive investment community ready and willing to invest; with bluebird bio, AveXis, Iovance Biotherapeutics and Sangamo Therapeutics all raising hundreds of millions to develop their regenerative medicine pipelines.

“We anticipate sustained investor commitment to this space, especially as more product candidates enter the clinic, and as those already there progress towards commercialization,” said Lambert. “Commercially, this sector is rapidly and adeptly addressing various manufacturing, industrialization, regulatory and reimbursement hurdles.”

While investor enthusiasm is evidently surging, the industry needs to now deliver on its promises and address some of the concerns investors have about return on investment. “We don’t have a lot of commercial success stories in this space yet,” Lambert told In Vivo. “There will be a time when investors will want to see that. They will want to see that these products can come to market, that patients can access them and that it can create a good business opportunity for them as investors. I think right now there’s still confidence that all of this will get worked out, but there are still issues that need to be worked out.”

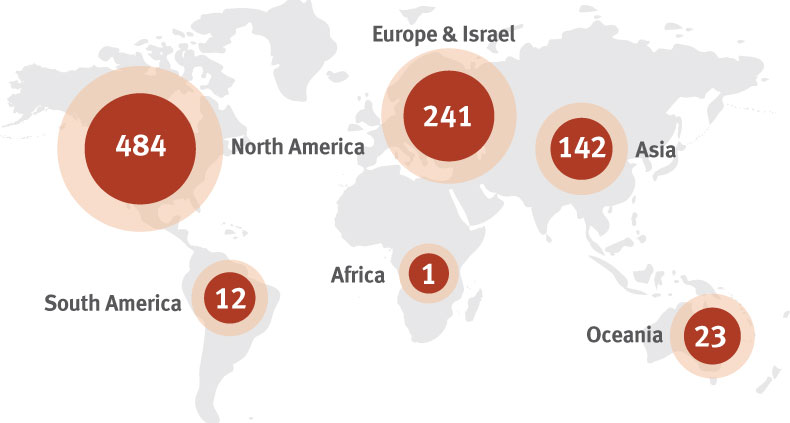

ARM is an international community of small and large companies, non-profit research institutions, patient organizations and other sector stakeholders dedicated to realizing the promise of regenerative medicine, globally. It works with its members and policymakers to foster investment, research and development, and successful commercialization of safe, effective, and transformational therapies for patients around the world. ARM’s 2018 Annual Regenerative Medicine Data Report details industry-specific statistics and trends from more than 900 leading cell and gene therapy, tissue engineering and other regenerative medicine companies worldwide.

“A lot of what ARM tries to do is to distil a point of view on behalf the advanced therapy medicinal product (ATMP) community globally and share that with policymakers so that they can understand from our broad stakeholder point of view what is it that this community thinks is needed in regulation, reimbursement and manufacturing,” said Lambert.

Lambert joined ARM in 2017 as the organization’s first CEO. With more than 25 years in public and private sector management, she most recently served as the acting head of engagement for the All of Us Research Program at the National Institutes of Health and as head of the Outreach Office in the Office of the NIH Director. She has also held legislative and staff leadership positions in the US Senate and House of Representatives.

European Approvals

Three approved ATMPs have created a buzz over the last 18 months: Novartis’s Kymriah (tisagenlecleucel), Spark’s Luxturna (voretigene neparvovec) and Gilead Sciences’ Yescarta (axicabtagene ciloleucel). There are more following their footsteps. The latest nod for a gene therapy came in March, when bluebird bio’s gene therapy Zynteglo (formerly LentiGlobin) for beta-thalassemia received a green light from the EU’s Committee for Medicinal Products for Human Use (CHMP) meeting – with a final approval expected in the second quarter of the year. bluebird is expected to start marketing the treatment by the end of the 2019.

The marketing authorization application (MAA) review broke records, thanks to the EMA’s various programs designed to speed the development and review of potentially ground-breaking products. As Zynteglo seeks to address an unmet medical need, it benefited from PRIME, the EMA’s platform for early and enhanced dialogue with developers of promising new medicines. “This interaction led to a more robust application package to demonstrate the medicine’s benefits and risks, which allowed accelerated assessment of Zynteglo in 150 days, the fastest advanced-therapy medicinal product review time to date,” the agency noted at the time.

Another product expected to come to the European market this year is Kiadis Pharma’s delayed leukemia drug ATIR101 (Allodepleted T-cell ImmunotheRapeutics), expected by the middle of 2019. The firm announced in October 2018 that it needed more time to answer questions the EMA had around the company’s MAA. However, the potential commercial launch date in a first EU member state remains the second half of 2019. ATIR101 is Kiadis's lead product. It is administered as an adjunctive to hematopoietic stem cell transplantation (HSCT) to provide for a safe donor lymphocyte infusion from a partially matched family member without the risk of causing severe graft-versus-host-disease. The product's T-cells help to fight infections in remaining tumor cells as the immune system regrows.

Expected by the end of 2019 is Novartis/AveXis’ therapy Zolgensma for spinal muscular atrophy type 1. And it is anticipated that Orchard Therapeutics will file a MAA in Europe for its gene therapies in adenosine deaminase deficiency and metachromatic leukodystrophy in 2020.

Therapy Areas

According to ARM, globally there were 1,028 clinical trials underway in 2018 that utilized specific regenerative medicine or advanced therapy technology. Gene therapy trials numbered 362, while cell therapy came to 263, with tissue engineering clinical trials amounting to 41.

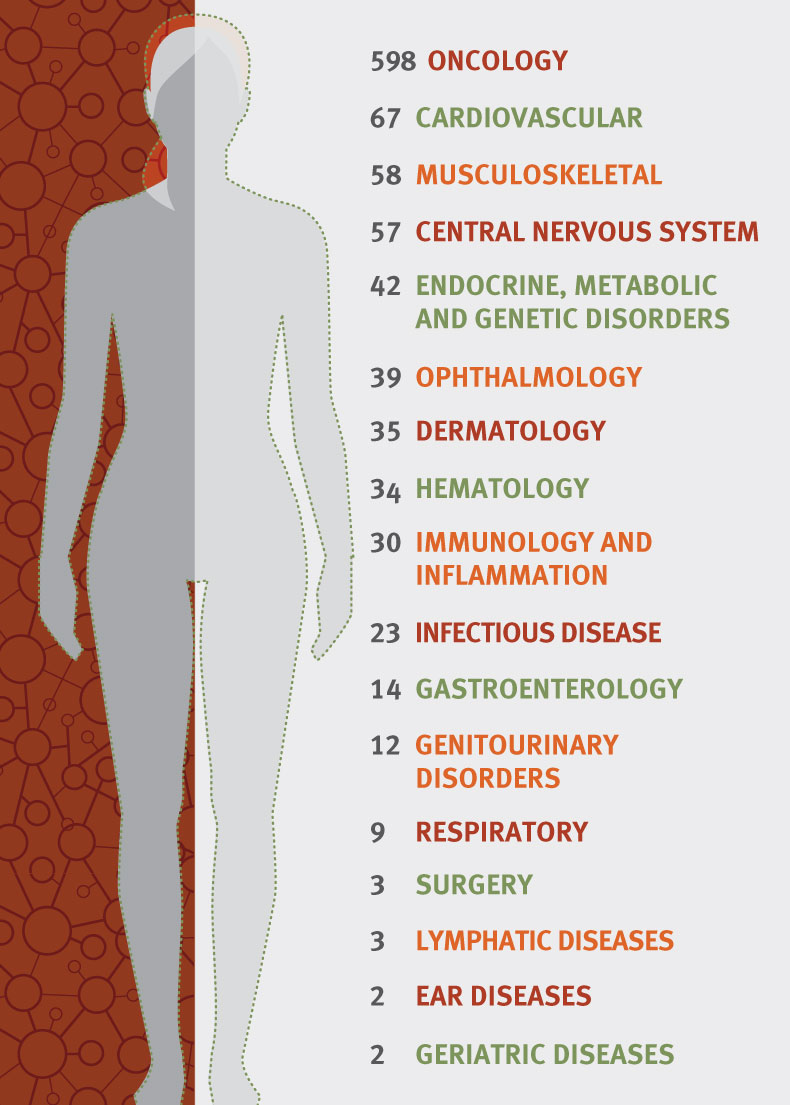

“Right now, if you look at the clinical trials that we’re tracking, over half of them are in oncology,” explained Lambert. “Most of those are in liquid tumors and blood cancers, one of the areas of really early progress in cell and gene therapies. A big mountain that developers are still trying to climb, even with all the work in oncology, is to try to make progress in solid tumors. I think there’s a lot of promising work in that area but that will be a very key development in cell and gene therapy.”

Lambert remarked that, after oncology, rare diseases that have a genetic basis are an obvious therapeutic area for ATMPs to be impactful. Gene therapies, with their ability to correct a genetic mutation instantly, have applicability across a whole wide range of rare diseases. “It’s impossible not to be moved by the plight of patients with rare diseases, and especially because so many of them are children,” said Lambert. “It’s so compelling, you really, really want to make progress in that space. I think we see in our membership a lot of companies are working in this space and have very strong relationships with the patient advocacy community around them. There’s just a lot of scientific promise, as well as human motivation to really solve problems in rare disease,” she said.

There is also a lot of work being done for diseases in the central nervous system, in Parkinson’s disease for instance, by companies such as Voyager Therapeutics. The pharma industry’s major challenge in developing therapies for neurodegenerative diseases that require frequent doses of large amounts of antibodies has been their delivery across the blood-brain barrier (BBB). Cambridge, Massachusetts-based Voyager has changed this approach by aiming to deliver a one-time intravenous dose of the genes that encode for the production of therapeutic antibodies using its BBB penetrant adeno-associated virus (AAV) capsids. This approach could result in the potential for higher levels of therapeutic antibodies in the brain compared with current systemic administration of antibodies.

Big pharma has been ratifying and investing in this approach, with AbbVie collaborating on both Parkinson’s and Alzheimer’s disease programs, while Sanofi-Genzyme has taken a keen interest in Voyager’s work in Huntington’s disease. Meanwhile, Bayer AG has invested in BlueRock Therapeutics, which has a cell therapy program in preclinical development for Parkinson’s disease. BlueRock is currently discussing the design of a Phase I trial for this cell therapy candidate.

That said, Lambert noted that the second most common therapy area in the current clinical trial landscape, after oncology, is cardiovascular (see Exhibit 2). “It’s not something people think about [in relation to gene therapy] but there’s a great deal of work going on in cardiovascular disease and some pretty promising clinical outcomes there.” Companies such as Cleveland-based Athersys and Casebia – a joint venture created at the end of 2015 by Bayer and CRISPR Therapeutics AG – are active in this therapy area yet taking very different approaches.

Casebia is engineering Cas9 nucleases with specific features to enable both viral and non-viral delivery technologies for its in vivo and ex vivo delivery of gene-editing therapies in hematology, cardiovascular disease, ophthalmology and autoimmune diseases. While Athersys is working on a Phase III trial to test its off-the-shelf cell therapy MultiStem in ischemic stroke.

MultiStem is manufactured from adult stem cells collected from bone marrow or other tissue donations. The cells can be expanded to produce millions of doses from a single donor, which can be frozen for years before use. Patients enrolled in the Phase III study will receive a single intravenous dose of MultiStem or placebo within 18 to 36 hours of experiencing a stroke on top of the standard of care. The primary endpoint is an assessment of disability according to modified Rankin Scale (mRS) scores at three months and will compare the distribution of disability for MultiStem-treated patients versus those who received a placebo.

Administration of MultiStem cells is expected to stop the immune system’s hyper-reaction to ischemic stroke, by stopping immune cells from rapidly leaving the spleen and heading to the brain, and to concurrently upregulate reparative efforts. Phase II results showing improvements in post-stroke disability at 90 days and beyond supported a Regenerative Medicine Advance Therapy (RMAT) designation from the FDA. Athersys is also testing MultiStem in a Phase II trial in heart attack and a Phase I/II study in acute respiratory distress syndrome.

European Market Access

“Overall globally, but also in Europe, the governments have been really engaged, supportive, and working hard and collaboratively to create a policy environment for this sector,” remarked Lambert. “I think that’s really a function of a general excitement about the clinical results that we’re seeing in the early products in this sector.”

The European Commission and the EMA, for example, have developed a specific ATMP plan of action and they worked closely with ARM and other stakeholders to pull together a comprehensive review of what can be done to facilitate the introduction of these products in the European market. In addition to this, in February the EMA issued draft guidance on investigational ATMPs, which makes a clear distinction between exploratory and confirmatory clinical trials, as the traditional approach of distinguishing between various stages of a clinical trial is not as well defined for such products. The guidance is out for consultation until August. (Also see "EMA Consults On Data Requirements For Cell And Gene Therapy Trials" - Pink Sheet, 25 Feb, 2019.)

With the EMA leading a Europe-wide co-ordinated effort for the authorization of advanced therapies, it is also starting to weigh in on Health Technology Assessments, Lambert said. “The European Commission is working with stakeholders to see if there are ways that there could be EU wide co-ordination of the scientific part of health technology assessment for ATMPs,” she said. “Obviously there would be some unique parts of each country’s HTA assessment, but mainly there are some parts of the scientific review that could be shared among the member states, creating efficiencies both for the member states as well as obviously for the sponsoring companies.”

Lambert is impressed with the many ways various European governments have been responsive to granting market access to ATMPs. New access schemes must be creative, because these therapies are not the typical medications you can take in a pill form once a day until you are cured. These are expensive one-time product with a long-term benefit, and this throws up unique challenges.

Commercial innovation is required too, she said, which involves government decision making. She cited Italy as an example, where the Italian Medicines Agency will only pay the €594,000 price tag for GlaxoSmithKline’s Strimvelis, a gene therapy to treat ADA-SCID, if the therapy works in a patient.

“We’ve had a period of incredible scientific innovation. Now we need commercial innovation for this sector,” Lambert told In Vivo. “That is like figuring out how to scale up manufacturing; how to have a distribution network that’s both personalized but also efficient.” She added that from a reimbursement and market access standing, the industry needed to still figure out how it can work with public and private payers to “effectively integrate these kinds of products into the health care system as we know it, and to do so in a way that is financially sustainable and delivers real access to patients.”

In one of the latest developments in gene therapy reimbursement, Novartis and GWQ, a group of German health insurers, announced a pilot scheme in March that will see the Swiss pharma firm repay some of the cost of its CAR-T cell therapy Kymriah if survival outcomes are not met. According to Novartis and GWQ, it is the first outcomes-based deal for an anticancer gene therapy and CAR-T therapy in Germany.

In the US also, the FDA has been as “forward leaning” to the potential of ATMPs as the European governments and policy makers. Lambert said that ARM has been made aware that the FDA has been trying to fill at least 30 new positions in and around cell and gene therapy.

Each geography has its unique set of challenges, the recent US government shut down, for example, makes a career in government service seem a little less attractive, and on the other side of the Atlantic there is of course Brexit, and the upheaval of moving the EMA headquarters from London to Amsterdam which creates personnel roadblocks.