Managing Lifecycles Amid Stifling Competition

Executive Summary

Biopharma is entering a new period of intense competition from new sources, requiring a change in approach to portfolio strategy and lifecycle management.

As pharma has pivoted towards biologics with higher barriers to competition, traditional drug lifecycles and patent cliffs have become a thing of the past. Older products can be enduringly lucrative, giving rise to concentrated investment in single pipeline-in-a-pill assets. In turn, this creates added incentives towards fast-follower approaches to R&D. Added to signs of biosimilar maturity, biopharma is entering a new period of intense competition from new sources, requiring a change in approach to portfolio strategy and lifecycle management.

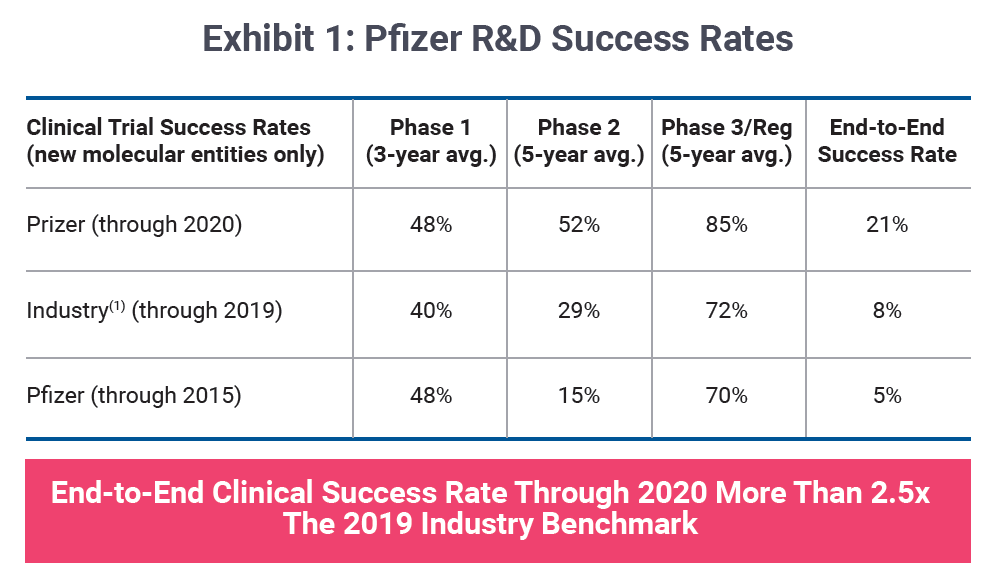

In recent years, a subtle change in narrative has emerged concerning portfolio strategy. Drug company executives are increasingly leading with probability of success metrics when gauging R&D performance and long-term pipeline potential. Pfizer Inc. is one such company toasting a four-fold improvement in its likelihood of approval, transitioning from laggard to leader over a five-year period as shown in Exhibit 1.

The simplest way to raise this is to pursue validated drug targets and mechanisms, often at the expense of first-in-class therapeutic opportunities, which alongside best-in-class was the old mantra and imperative for portfolio strategy. In a world where biotech advances are spawning a variety of new ways of creating drugs, there is much more room for clinical differentiation against known targets compared to small molecule drug design. As the definition of class stretches to include this range of drug design and delivery, first-in-class or best-in-class becomes a more nebulous concept. An emerging example of this is BCMA-targeting drugs, where cell therapies, antibody-drug conjugates and bispecific antibodies are all converging as new options to treat multiple myeloma.

The direct consequence of R&D strategies and pipelines being optimized for probability of success is the concentration of competition within certain therapy areas and drug targets. The classic example still playing out today can be seen in the PD-1/L1 inhibitor class. Even despite the insurmountable lead that forerunners Keytruda (pembrolizumab) and Opdivo (nivolumab) possess, dozens of newly designed antibodies are created each year, without any realistic hope for a return on investment. A similar picture occurs across many oncology and immunology targets as fast-follower approaches are employed. This is in spite of discovery science continuing to deliver therapeutic opportunities at a consistent pace. Each year, the biopharmaceutical industry R&D database Pharmaprojects adds around 100 novel targets that drugs are designed against, with 2020 showing a record 139 targets mentioned for the first time.

Fast-Follower Chinese Biotechs Are Enabling Disruptive R&D And Pricing Models

The ultimate fast-follower approach is emerging from China. Over the last decade, the domestic biopharmaceutical scene has transitioned away from off-patent molecules and instead focused on the creation of innovative drugs. As a collective, Chinese biopharma has sustained an incredible 30% compound annual growth rate in the number of new chemical or biological entities originated domestically over a 10-year period (see Exhibit 2). In a mirror image of the global trend, approximately 60% of these drugs are biological rather than chemical, with a strong emphasis against established drug targets within oncology and immunology.

For emerging targets, the pace at which Chinese biotechs can now discover and develop a proprietary therapeutic is beginning to rival the timelines of first-in-class drugs from large multinational pharmaceutical companies. Again, turning to the BCMA class as a case study, the Legend Biotech-originated CAR-T cilta-cel, now partnered with Johnson & Johnson, is poised for US approval in November 2021, just one year behind the first global availability of GSK’s Blenrep. This is one of a growing number of examples of Western companies seeking to license innovative assets from the labs of Chinese companies. Both Novartis AG and Eli Lilly and Company have acquired ex-China rights to PD-1 inhibitors, while Biogen sourced its BTK inhibitor from Beijing-based InnoCare Pharma Ltd.. With the addition of Chinese R&D players into the traditional competitive mix, the number of sources of innovation and potential business development partners is much larger. The natural progression will surely eventually see such companies expand commercial ambitions beyond the domestic market and seek to develop and market in the west.

This will be achieved not only through fast-follower drugs with competitive clinical profiles, but also through pricing disruption. Heavy discounts required to secure access to the National Drug Reimbursement List (NRDL) in China are difficult to reconcile with free market pricing practices in the US, meaning that potential Chinese entrants will undoubtedly enter international markets at lower cost. In the meantime, the availability of Chinese assets for licensing affords a new business model for start-up companies seeking to lower drug prices. Much has been written about EQRx, Inc. and its lofty goal of remaking medicine. (Also see "EQRx Aims To Dent Saturated, But Still Expensive, PD-1 Market" - Scrip, 28 May, 2021.) A major tenet of its strategy thus far is to acquire late-stage assets with high probability of success from Chinese biotech companies. It is doubtful that one company alone can address the systemic challenges of healthcare expenditure, drug prices and patient access, although EQRx’s mission appears to have also inspired incumbent companies. Eli Lilly is now talking openly about pricing its Chinese-sourced PD-1 inhibitor sintilimab at a significant discount.

Biosimilar Market Reaching Sustainability

In addition to the heightened competition from other innovative drugs during the patent-protected period of a drug’s lifecycle, the first signs are emerging that the biosimilar market may finally be delivering meaningful savings following loss of exclusivity. This can be seen through the lens of Roche Holding AG’s recent results, during a period in which is facing new biosimilar competition in the US for its three major oncology brands Avastin (bevacizumab), Herceptin (trastuzumab) and Rituxan/Mabthera (rituximab). Over two years, these brands have lost approximately 60% market share each, far higher than past examples would have suggested that Roche could expect. This has translated into a considerable revenue hole, exceeding $10bn, that will take years of growth for new products to fill. As noted by Roche executives Severin Schwan and Bill Anderson, “The impact of biosimilars was significant, somewhat higher than we originally expected [CHF5.7bn] … We think this year, in 2021, the number will probably be closer roughly CHF4.6bn.”

This evidence for the performance of oncology biosimilars, plus an upcoming wave of 15 notable new biosimilar opportunities including Humira (adalimumab) in the US, have led analysts at Bernstein to project a $19.3bn opportunity by 2027 (see Exhibit 3). The first interchangeable biosimilar in the insulin class will also help wider stakeholder acceptance. (Also see "First Interchangeability Designation Opens Doors For Biosimilars" - Generics Bulletin, 17 Aug, 2021.)

In the short term, an attractive biosimilar ecosystem threatens biopharmaceutical revenues considering the industry-wide portfolio switch towards biologic therapies. Nevertheless, it is vital for the long-term health and sustainability of the wider market. Any initiative that provides budget savings on older drugs is helping the industry achieve its social contract whereby access to medicines increases over time. Companies with leading R&D capabilities are subsequently rewarded as spending power is returned for innovative drugs and underserved patients. Undoubtedly originator companies will still act within – and occasionally outside of – the spirit of regulations to defend against biosimilars, although their presence should be embraced. The alternative solution involves policy intervention and price negotiations that may harm innovators throughout the lifecycles of their drugs.

Lifecycle Management Strategies Must Adapt To New Threats

Pharma companies can expect to face stifling competition at every stage of the drug lifecycle. There are multiple new sources of competition, from risk-conscious innovators exploiting the increasing biological complexity of drugs to create low-cost fast followers, or a sustainable biosimilar market that can finally deliver cost savings on off-patent antibodies.

As a consequence, the pipeline-in-a-pill approach to lifecycle management, whereby the developer concentrates investment in a single asset to pursue as many indications as possible, will be unable to deliver comparable longevity. (Also see "Pipeline-In-A-Pill: Still A Winning Strategy?" - In Vivo, 17 Nov, 2020.)

Fast-followers will curb the lead that a first-in-class drug can achieve, while any return on investment deep into a drug lifecycle is diminished by market share losses once biosimilars arrive. Drugs such as Humira and Keytruda will not be able to secure such dominant positions in the future. Rather, lifecycle management should be hedged across a range of assets at a portfolio or platform level to mitigate the risk of single competitors. In the decade ahead, successful companies will achieve this through diversification within their areas of focus, whether that is pharma companies and therapeutic area portfolio strategy, or biotech companies with novel drug platforms.

The ultimate way to get ahead of the competition lies in the strength of data supporting a drug. For this reason, the industry must embrace drugs with curative potential, not to mention the benefit that patients can derive from these. While certain technologies such as cell and gene therapies may be able to deliver functional cures, conventional drugs can be tested against more ambitious endpoints. Recent examples including hepatitis C antivirals through to COVID-19 vaccines show that drugs with curative data can achieve incredibly high sales early on in their lifecycles, saturating the opportunity for would-be competitors.

This article is based on a series of presentations prepared by Daniel Chancellor, thought leadership director at Pharma Intelligence, in collaboration with colleagues Duncan Emerton, Ly Nguyen-Jatkoe and Timothy Pang in October 2021. If you have any questions about any of the themes discussed in this article, or would like to learn more about Pharma Intelligence’s products and consulting offerings, please contact Daniel: [email protected].