Market Intelligence

Are you sure you'd like to remove this alert? You will no longer receive email updates about this topic.

Financing Quarterly Statistics, Q1 2024

During Q1, biopharmas brought in an aggregate $30.1bn in financing and device company fundraising totaled $2.8bn; while in vitro diagnostic firms and research tools players raised $724m.

China VBP, Localization And Other Strategies - How Far And Which Way?

Could health sector players encounter issues similar to those facing Tesla in China, a country which virtually saved the electric vehicle maker but where it is now facing challenges? Are there any lessons to be learned from a success story under China's volume-based procurement scheme? A partner at EY looks at these and other issues.

Deals in Depth: March 2024

Two $1bn+ alliances were penned in March. In the top alliance by deal value, Merus NV will use its Triclonics anitbody platform to discover new dual tumor-associated antigens targeting trispecific antibodies for Gilead Sciences. Merus will lead early-stage research activities for two programs, with an option to pursue a third. Gilead will have the right to license programs developed under the collaboration after the completion of select research activities. If Gilead exercises its option to license any such program from the collaboration, Gilead will be responsible for additional research, development and commercialization activities for such program. The deal could be worth up to $1.5bn for Merus.

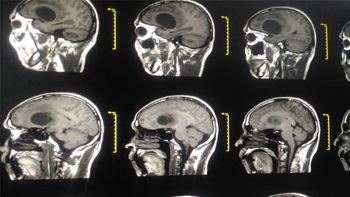

Glioblastoma Market Snapshot: Two Approvals In 2024 And A Rich Pipeline

Glioblastoma carries a grim prognosis. The biopharma industry is trying to improve patient outcomes, with 120 drugs in the pipeline and two anticipated approvals this year.

Stick, Twist Or Split? Generics Industry’s Big Three Place Their Bets

With Teva and Viatris recently under new management and Sandoz having last year split from former parent company Novartis, the three off-patent industry leaders are adopting different strategies for how they balance their generics and biosimilars interests with more innovative ventures.

A Snapshot of Updates In The APAC Region

US-China tensions, the increasing importance of Singapore as a doorway to the Asia-Pacific region, growing AI innovation in South Korea and a changing clinical trials landscape in Japan are just some of the recent developments in APAC.

France: A European Leader In Rare Diseases

France has long been a European leader in rare diseases, from its scientific research and academic hospitals, through to patient advocacy and regulatory reforms that have encouraged R&D. Its biotech and pharmaceutical industries are now leading the way, discovering the next generation of therapies for patients that are often overlooked.

Deals Shaping The Industry, February 2024

An interactive look at pharma, medtech, and diagnostics deals made during February 2023. Data courtesy of Biomedtracker.

End Game: Adrenomed Targets Global Reach For Sepsis Candidate

German biotech Adrenomed has proof-of-concept data showing its sepsis drug can cut mortality by 67%. Now, it needs money to move the candidate into Phase IIb/III trials.

J&J Refines Direction For Ottava

Delays have plagued J&J's soft tissue surgical robot. However, the company has now solidified at least its near-term plan and hopes to commence trials later this year.

CGT Is In Its Infancy For CNS Disorders, But Technical Strides Being Made

Technical challenges and lackluster investor sentiment about the near-term commercial potential of cell and gene therapies in neurological disorders may be holding the field back.

Deals in Depth: February 2024

Just one $1bn+ alliance was penned in February, compared to ten in the previous month. In the top alliance by deal value, Neomorph and Novo Nordisk entered into a potential $1.46bn agreement for the discovery, development, and commercialization of molecular glue degraders (MGDs) for cardiometabolic and rare diseases. The collaboration brings together Novo Nordisk's expertise in those disease areas with Neomorph's MGD discovery platform. Neomorph will lead discovery and preclinical activities against selected targets with Novo Nordisk having the right to exclusively pursue further clinical development and commercialization of the compounds.

Nouscom Aims To Ride Neoantigen Cancer Vaccine Wave

Nouscom, with one major partner and strong confidence, is building research and manufacturing foundations to address significant market needs with its neoantigen cancer vaccine platform.

AI Uses During Lifecycle Of Medicinal Products And Medical Devices: An EU Regulatory Perspective

Despite expectations in some circles in December 2023 that adoption of the EU AI Act was imminent, the scope of the final text and when it will be published remain unclear. There are, however, related consequences that can be anticipated.

What Big Pharmas Are Looking For In Partners

With all signs pointing towards a year ripe with partnering opportunities, four big pharma dealmakers reveal what they are looking for.

Deals Of The Year 2023 Winners Revealed

For In Vivo's 16th annual Deals of the Year contest, we selected 12 nominees in three categories – Top Alliance, Top Financing and Top M&A. The polls are closed, and it is time to reveal the winners.

You must sign in to use this functionality

Authentication.SignIn.HeadSignInHeader

Email Article

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.