Are We Witnessing The Mainstream Emergence Of RNA?

Executive Summary

Charting the development history and evolution of monoclonal antibodies as a therapeutic class reveals industry was slow to recognize their potential. The first 50 approvals took place over three decades, although the subsequent 50 were condensed into just five years as MAbs firmly revolutionized the treatment of a huge number of diseases. In Vivo asks whether RNA therapies, similarly underappreciated in the early days of development but now firmly in our collective conscience owing to their role in the pandemic response, are on the cusp of entering mainstream R&D?

For many years, the prospect of harnessing RNA biology to produce new pharmaceuticals has been on the periphery of drug development. Despite the first antisense oligonucleotide (ASO) gaining approval in 1998 – the same year as the discovery of RNA interference (RNAi), which was later awarded a Nobel Prize – wider interest in the class has yet to take off. Back in 2015, there were an equivalent number of RNA therapies under active investigation as gene therapies, although in the years since the gene therapy pipeline has ballooned five-fold to reach approximately 1,700 candidates. The RNA class – encompassing gene expression modifying approaches such as single-stranded ASOs and double-stranded RNAi, as well as messenger RNA (mRNA) vaccines and therapeutics, in addition to a range of alternative non-coding approaches, has merely doubled over the same period.

As of May 2021, Pharmaprojects lists just shy of 200 separate RNA programs in clinical development, with a further 500 at the preclinical stage (see Exhibit 1). Antisense is the most common technology among the most advanced drugs, although the earlier stages of development are packed with RNAi and mRNA drugs, as the field pivots towards these newer modalities. A recent spate of RNAi approvals, added to a global awakening to the potential of mRNA vaccines, is accelerating the creation of new pipeline assets. For the last 12-month period, the RNA pipeline has grown at a faster rate than gene therapies, suggesting the class is finally taking its own share of the spotlight.

Aided by the boost in funding of mRNA research, and consistent growth in RNAi programs, there are currently 121 RNA clinical trials that have either started, or are projected to, in 2021. This is a 50% increase over the year prior according to data from Trialtrove, highlighting the acceleration in interest for RNA therapies and vaccines.

Gene Silencing Must Overcome Delivery Challenges

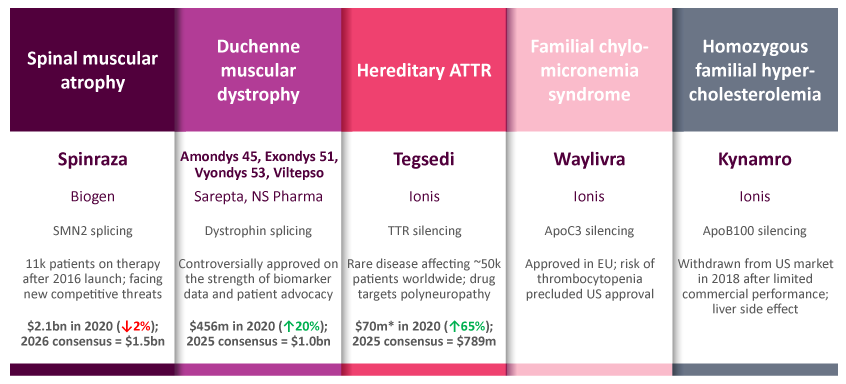

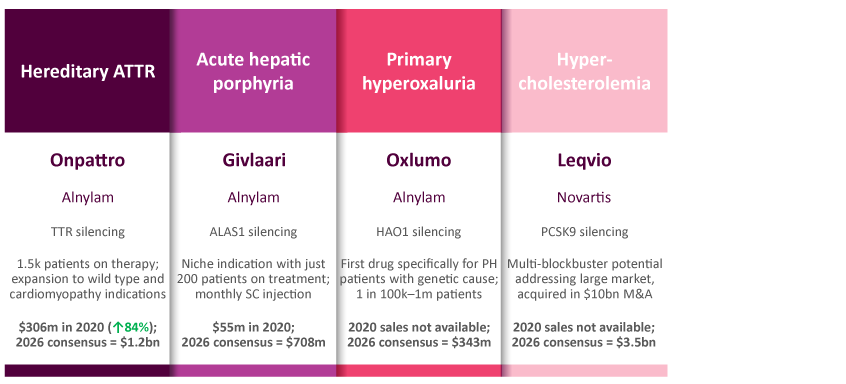

The majority of RNA therapies to date focus on modifying gene expression via the creation of a short nucleotide sequence with complementary base pairing to the target mRNA. Through a range of mechanisms, this commonly “silences” gene expression by reducing transcription of the mRNA code into its corresponding gene product. Slight nuances in target design can also allow a positive correction, either through modifying splicing to increase production of full-length functional protein, or increasing expression by designing an RNA sequence complementary to the promoter region of a gene. Eight ASOs are currently approved by at least one regulatory body across five discrete diseases, while a further four RNAi products are on the market (see Exhibit 2).

Exhibit 2.

Antisense Oligonucleotide Therapies

Widely Diverging Fortunes With Few Winners Among The 8 ASOs To Have Gained Approval

RNA Interference Therapies

Fewer Approved Drugs, But Arguably Of Better Therapeutic And Commercial Quality

Source: Biomedtracker, May 2021

After decades of platform development, these single- and double-stranded RNA species bear little resemblance to the endogenous mRNA that they are targeting. In order to improve upon the natural pharmacokinetics, a variety of chemical modifications are employed to the RNA backbone, in addition to conjugation to moieties that aid cell penetration. This, coupled with advances in delivery technology such as lipid nanoparticles, has enabled gene silencing with RNA drugs in hepatocytes across a range of liver indications. In recent years, the drug discovery platforms built by pioneers such as Alnylam and Ionis have been able to create viable new drug candidates at pace, progressing through clinical development with high degrees of success.

Within the current competitive dynamics in liver diseases, evidence is beginning to stack up in favor of RNAi as the superior approach to gene silencing. The rare disease of hereditary transthyretin amyloidosis (hATTR) uniquely has both ASO and RNAi-type drugs approved in Tegsedi (inotersen; Ionis Pharmaceuticals, Inc.) and Onpattro (patisiran; Alnylam). While Tegsedi is dosed subcutaneously every week, contrasting intravenous infusions for Onpattro every three weeks, it has a black box warning owing to the risk of thrombocytopenia. Onpattro has set the higher bar for efficacy, and may have clinical application to a larger patient pool including wild type ATTR. In vutrisiran, currently under regulatory review, Alnylam also possesses a second-generation RNAi that provides a subcutaneous option that can be dosed quarterly. In a separate example, the ASO Spinraza (nusinersen; Roche), hugely successful with approximately $2bn in annual sales for spinal muscular atrophy, is beginning to be outcompeted by more convenient treatment options. The potentially curative gene therapy Zolgensma (onasemnogene abeparvovec; Novartis) is a one-time treatment, while Roche has launched Evrysdi (risdiplam) as a once-daily pill targeting the same SMN2 mis-splicing pathway, which is far more patient-friendly than Zolgensma’s intrathecal injection.

Despite numerous successes and first-to-market opportunities, the application of gene silencing to non-liver indications has proven consistently problematic. The recent failures of two ASO approaches to Huntington’s disease exemplify this clearly. Despite employing highly optimized RNA backbones, both tominersen (Ionis/Roche) and a pair of candidates from Wave Life Sciences failed in their Phase III and Phase I/II trials, respectively. The post mortems of these trials are expected to show that a combination of insufficient gene silencing and inadequate penetration of deep brain structures contributed to their failures, prompting industry commentators to question the longevity of antisense as a technology. Attention will now turn to Biogen’s trial of tofersen in amyotrophic lateral sclerosis as the next test in a major non-liver indication, with the VALOR trial due to complete by late 2021. The long term therapeutic relevance of gene silencing both via ASOs and RNAi will depend upon addressing delivery challenges into tissues such as the brain, lungs, and kidneys.

mRNA Potential In Prevention And Treatment Is Near Limitless

The upstart mRNA technology has truly been a savior in times of pandemic, producing vaccines not only at quicker speeds than rivals, but also with best-in-class clinical profiles and subsequent manufacturing scalability and consistency. Pfizer/BioNTech and manufacturing partners are guiding to deliver around 3 billion doses of the Comirnaty vaccine this year, while Moderna is expecting to reach comparable scale in 2022 after contributing up to 1 billion doses this year. This astounding performance will yield record-breaking commercial returns, with the two companies guiding for 2021 revenues of $26bn and $18bn, respectively, based on advance purchase agreements made to date. By way of comparison, the most successful drug in the history of the pharmaceutical industry is Humira (adalimumab; AbbVie), which has finally achieved annual sales of $20bn after over a decade of clinical investment and commercial execution. (Also see "Top 10 Best-Selling Drugs Of 2020" - In Vivo, 14 Jun, 2021.)

The success of the forerunner mRNA COVID-19 vaccines is all the more remarkable considering that they are first generation. The technology is still nascent, with only tentative clinical investigations against select infectious diseases and as cancer immunotherapies outside of the huge body of COVID-19 evidence. Over time, continued platform development may be able to soften perceived competitive weaknesses such as thermostability and immunogenicity. As shown in Exhibit 3, the majority of mRNA-type drugs are designed as either anti-infectives or cancer vaccines. Indeed, the later stages of drug development exclusively belong to vaccines against SARS-CoV-2, although Moderna intends to progress its first non-COVID-19 vaccine into Phase III development later this year. Note the rare diseases grouping is an umbrella term and duplicates many of the less common infectious diseases and oncology programs.

Quotes from the respective chief executive officers of BioNTech and Moderna succinctly sum up the legacy of the pandemic for their biotechs. Speaking about a return to the company’s origins, Uğur Şahin emphasizes, “Our long-term goal remains to build a 21st century global immunotherapy powerhouse developing products for multiple disease areas.” Stéphane Bancel comments on the legacy of the incredible scale of investment, “We have a financial means that we never had before … The appetite to invest in innovative vaccines is, I would say, almost limitless.” Both companies will be able to bring their newfound firepower to bear on opportunities in other infectious diseases and cancer, expediting programs that were in development prior to the pandemic, and also explore the tantalizing potential of mRNA as a therapeutic strategy via the in vivo production of a beneficial protein, rather than an immunogenic antigen.

Most immediately, the opportunity lies with translating the clinical profile of the COVID-19 mRNA vaccines against other pathogens for which a vaccine is not yet available. Moderna’s hexavalent vaccine against cytomegalovirus (CMV), mRNA-1647, will be moving into an 8,000-patient Phase III trial this year. The company has Phase II data in hand showing strong neutralizing antibody titers, albeit with the requirement for three separate injections. CMV itself is highly prevalent and typically causes mild infection only, but it is the leading cause of congenital infection worldwide and traditional vaccines have struggled to match the virus’s genetic complexity. Success here will be important to show the potential for multivalent mRNA vaccines against other complex antigens. Proof-of-concept clinical data are also available for mRNA candidates against respiratory syncytial virus (RSV), but it is the opportunity in influenza that is attracting a lot of interest and competition. The rationale supporting mRNA is that the technology can be used to create and manufacture vaccines at scale much more quickly than traditional approaches, allowing for closer matching to the circulating strain and improved efficacy profiles. Sanofi and Moderna will both progress mRNA influenza vaccines into early clinical development in 2021.

There are two different approaches to vaccines against cancer, which is an altogether more competitive space considering the involvement of different modalities such as cell therapies and monoclonal antibodies. mRNA is particularly suited to personalized neoantigen vaccines, whereby individual tumors are sequenced and analyzed for cell surface neoantigens against which an immune response could be raised. This offers the potential for a highly tailored treatment, accompanied by deeper and more durable responses. The speed of mRNA vaccine development here is a critical advantage compared to other platforms, as these patients have advanced tumors and potential outcomes will worsen the longer it takes to initiate treatment. The other approach is targeting tumor-associated antigens, which are the common oncogenic drivers found across a range of different cancer types and locations, such as HER2 and KRAS. In these settings, cancer vaccines are likely to be used as adjuvants alongside checkpoint inhibition in tumors that are immunologically “cold.”

As a therapeutic strategy, mRNA affords tremendous disruptive potential. Although early in development and not clinically validated, mRNA can be harnessed to produce any beneficial protein in vivo using a patient’s own ribosomal machinery. This could be to increase levels of a therapeutic protein, even for a highly optimized drug such as a monoclonal antibody, or to replace a protein that is deficient in a particular disease state. BioNTech has recently revealed that it is exploring the production of bispecific antibodies using the mRNA route, which may confer pharmacokinetic and manufacturing advantages. Considering the ubiquitous involvement of proteins in human biology, the potential for mRNA-encoded therapeutic strategies is near limitless. Example programs in clinical development thus far span a diverse range of treatment settings such as cystic fibrosis, cancer, enzyme replacement and heart failure.

This article is based on a series of presentations prepared by Daniel Chancellor, thought leadership director at Pharma Intelligence, in collaboration with colleagues Mark Lansdell, Ly Nguyen-Jatkoe and Timothy Pang in May 2021. If you have any questions about the themes discussed in this article, or would like to learn more about Pharma Intelligence’s products and consulting offerings, please contact [email protected].